Service notice –Testing testing

Facilitate business integrity

Core workstream - Combatting financial crime together

Key 2024 actions

- Responding to the Moneyval report to shore up regulatory effectiveness and Jersey’s long-term reputation

Core workstream - Conduct and prudential

Key 2024 actions

- Establishing a route towards a Basel III regime for banks, bringing Jersey in line with international standards

- Introducing a new consumer lending conduct regime to protect islanders from poor practice

Harness technology and influence the digitalisation of financial services

Core workstream - Digital transformation

Key 2024 actions

- Simplifying our technical architecture to make us more efficient and resilient

- Delivering a digital obliged persons register to meet international standards

- Delivering a new digital system for Enforcement, enhancing management information, intelligence sharing, and providing greater insights into trends

- Rolling out a core upgrade to our Registry system to improve stakeholder experience

- Delivering other digitised regulatory processes, including information submission to Supervision, to simplify industry’s experience of working with us

Develop our people, systems, and capability to be a high performing organisation

Core workstream - People and culture

Key 2024 actions

- Building succession planning and career pathways to provide stability for industry

- Developing organisational capability and capacity, enhancing industry’s experience of working with us

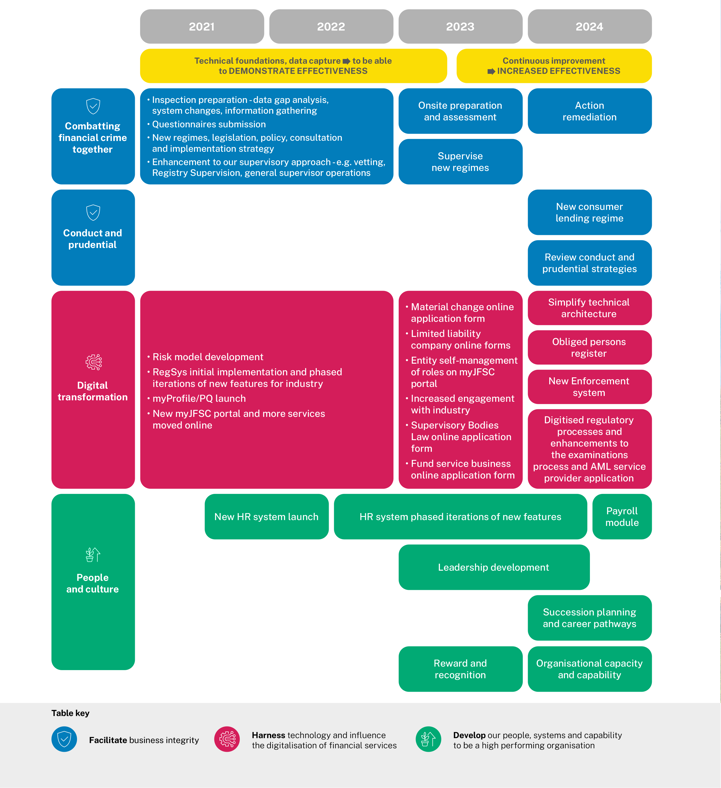

Core workstreams 2021 - 2024

Combatting financial crime together

Our top strategic priority is to achieve sustainable, long-term excellence in regulatory effectiveness, and increased capability in combatting financial crime.

Financial crime has a real human cost, funding terrorism, human trafficking and other serious crimes. Working alongside the Government of Jersey, industry and other relevant agencies, it’s our responsibility both as Jersey’s financial services regulator and as members of the international community to make sure we’re effective in preventing it.

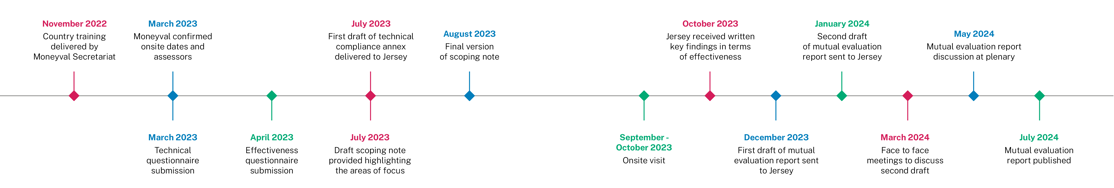

We also need to be able to demonstrate that effectiveness to international bodies like the Financial Action Task Force on Money Laundering (FATF). In October 2023 we welcomed the Council of Europe’s monitoring body, Moneyval, to Jersey to assess the island’s technical compliance and effectiveness in countering money laundering, the financing of terrorism and proliferation financing. We spent 2023 in the preparation stage for this assessment. In 2024 we will move into the receipt and response stages of the process.

In Q1 and Q2 of 2024, different agencies including the Government of Jersey and the JFSC will have an opportunity to input comments on Moneyval’s draft mutual evaluation report, which contains their key findings from the review. Throughout this period, we’re unable to provide any public comment on the findings.

The final report will be approved at a plenary in May 2024, with the publication anticipated in July 2024. At that point we will be able to publicly share our response to the findings and any associated remediation actions.

Alongside being a health check for the whole island, the Moneyval preparation, review and response process results in enhanced financial crime knowledge across the JFSC and industry, directly furthering our vision.

Together with providing technical, strategic and operational support in relation to the Moneyval assessment, our Financial Crime Coordination team will also complete a review of the JFSC’s financial crime capability, ensuring that regulatory and supervisory effectiveness are fully embedded and regularly assessed going forwards.

Throughout and beyond the Moneyval assessment process, we want to protect and enhance the island’s reputation as a well- regulated jurisdiction, attracting high-quality business and sustaining good market access.

Conduct and prudential

Our main strategic priority is achieving sustainable, long-term excellence in regulatory effectiveness, and increased capability for Jersey in combatting financial crime. We will build on the progress made in 2023 by developing our data collection and analysis to better measure the effectiveness of supervisory interventions. During 2024, we will also review the current policy and supervisory approach to conduct and prudential risks to ensure we have a good balance of supervisory oversight of business models and treatment of local customers.

Our approach to prudential risk will include a review of our banking regulations to align our policy framework to prevailing Basel standards to support cross-border banking businesses. We will take a pragmatic and phased approach to the implementation of these standards. In our supervisory approach, we will examine how banks and non-banks manage their prudential risks. This includes how boards or management bodies exercise appropriate oversight of their business models to ensure medium-term viability and mitigation of risks.

During 2024, we will also enhance our supervision of conduct risks. This includes the availability of local services provided by financial services firms, and the standards of client treatment, including the quality of information used to support services provided to consumers. This enhanced focus on conduct and prudential risks will bolster Jersey’s reputation as a well-regulated jurisdiction, making our island a leader among international finance centres and further aligning our regulatory framework with international standards.

We expect firms to have appropriate governance in place to ensure that they understand and mitigate their risks, take appropriate measures to support the viability of their businesses into the medium term and engage appropriately with and support their customers. Our supervisory approach across financial crime, conduct and prudential risks will support a dialogue with firms on the way they are achieving appropriate outcomes in those areas.

Meanwhile, the Government of Jersey is also considering new provisions on consumer lending to provide greater consumer protection, including through the provision of information to consumers. We will support the development of these regulations through research and taking preparatory measures for implementation so that financial firms impacted by the new regime have time to lay the groundwork. The timeframe for implementation will be set in due course and our policy framework will evolve in line with it.

Digital transformation

Our goal is to be a digitally enabled regulator, providing secure, reliable access to our systems for both the JFSC team and industry stakeholders. We want to identify and develop digital solutions that make it easier for everyone to be effective and efficient.

Protect and sustain

Evolve and innovate

External influence

Engaging effectively with the Government of Jersey, Jersey Finance and Digital Jersey to support the adoption of technology solutions across industry.

We will continue to build skills, capacity and understanding of technology and data.

In 2024 we will deliver

- Improved data collection processes by enhancing our data integration capabilities

- A digital obliged persons register to comply with international regulation

- A core upgrade to our Registry system to improve both internal and external user experience

- A new system for our Enforcement team to enhance our case management, document repository, workflows, approvals processes and status tracking of investigations

- Improvements to our Supervision team’s system to address internal and external stakeholder feedback received in our latest industry survey

- A PDF chatbot, starting with our AML/CFT Handbook, to generate a quicker and more direct response in conversational language with reference to the relevant section

- New RegTech policy guidance for industry

- Enhancements to our Registry APIs and addition of new services

- Enhancements to our website to include improved search functionality, signposting and guidance

People and culture

Our people strategy is essential to achieving our vision of being a high performing organisation. Our goal is to create a leading employment experience where our people are high performing, role model our values and enjoy professional and personal development, building confidence and competence for now and the future.

Thanks to the progress made during 2023, our senior leadership team is now largely in place, employee turnover has reduced, and we have implemented progressive approaches to recognition and performance management. These changes have effectively responded to industry’s feedback from our 2023 survey, where turnover was identified as a key area of concern. With the foundations fully established and being embedded, we are now able to go to the next stage of our plan. We will continue to bring our employee value proposition to life, which we define as “Purpose, Passion, Pride”, but with a distinct focus on building organisational capability and capacity.

Key areas of focus will be:

Leadership and people management

Development

Values and behaviours

Strategic workforce planning

International and local engagement

Our in-person international and local engagement programme was enhanced in 2023 following the removal of COVID-19 travel restrictions. We will build on these increased activity levels in 2024 to develop key relationships with local and international stakeholders.

International engagement is an important vehicle for us to engage with stakeholders. Our interactions with international bodies including FATF, International Organization of Securities Commissions (IOSCO) and Group of International Finance Centre Supervisors (GIFCS) directly contribute to our vision, supporting regulatory effectiveness and protecting Jersey’s long-term reputation as a well-regulated international finance centre.

We will develop and reinforce our relationships with other international regulators in 2024, including to support our work to strike an effective balance between our focus on combatting financial crime and conduct and prudential.

We will continue to increase engagement locally with the arrival of our new Chair, working alongside our Director General, Executives and subject matter experts.

Continuous improvement

In 2024 we will sustain our focus on developing a culture of continuous improvement at the JFSC through the introduction of an Operational Excellence function within our Change team.

By providing relevant training and support, our goal is for all our people at every level and in every division to be empowered to bring about change and continuous improvement in the course of their day-to-day work.

This work will include encouraging everyone in our team to suggest ideas for improvement, alongside evaluating our current processes to find opportunities to cut unproductive work or introduce automation and simplification.

In 2024 we will:

- Implement an enhanced assurance framework to support our organisational growth

- Continue to deliver improvements based on industry survey feedback

Our goal is for our continuous improvement focus to have a significant positive impact on external stakeholders’ experiences, speeding up service delivery and improving outcomes for everybody.

Fee review

Our commitment to innovation

Sustainable finance

Jersey private funds

Virtual assets

We will continue to work closely with virtual asset service providers (VASPs) to support their compliance with FATF requirements in relation to the Travel Rule, which requires transfers of virtual assets to be accompanied by accurate originator and beneficiary information.

We will continue to monitor the emergence of different conduct and prudential regimes for virtual assets around the world, including markets in crypto assets regulation in Europe and the developments of the UK’s crypto asset regulations.

We will continue to explore where asset tokenisation fits within existing regimes and develop our understanding of the opportunities and challenges of this new form of asset.

Thank you for your feedback.

To help us improve, tell us more about your visit today. Please fill in this short feedback survey.

This website uses cookies to analyse our traffic. To find out more read our cookie policy.