Service notice –Testing testing

Summary of our key financials

Our 2024 budget requires us to successfully manage several factors including:

-

The increased regulatory perimeter to ensure Jersey meets international standards in combatting financial crime

-

Continuing to improve employee retention and increase headcount to target levels, ensuring we have the capacity and capability to deliver regulatory effectiveness and improved service levels

-

Continued inflation risks, underlining the need to benchmark salaries and carefully manage our cost base

-

The need for continued investment to enable effective delivery of our strategy alongside our core business-as-usual functions

Provision should an additional level of remediation be required in response to the Moneyval assessment Provision has not been made within our budget to enable access to the beneficial owner and controller information to obliged entities in line with the commitment made by the Government of Jersey. Analysis is underway to ensure the right solution is available within the committed timeframes, following which we will be able to determine the costs. This will be funded from reserves.

We will continue to use retained liquid assets from previous years. This aligns with our agreed approach to financial resilience.

Our priority is to strike a careful balance between strategic investment in priority areas and careful management of our liquid asset levels to minimise future fee increases.

To achieve this, we will continue to use retained liquid assets from previous years. This aligns with our agreed approach to financial resilience. We have budgeted a £2.3m deficit in 2024 and aim to return to break-even by 2026 based on using our reserves in the short term to pre-fund new regimes and then recouping those costs smoothly over a number of years, alongside reaping the benefits of investment we have already made in processes and technology.

We’ve made a range of targeted investments to ensure regulatory effectiveness and improve service delivery. Our investments have been detailed throughout this business plan and span digital improvements, enhancements to our regulatory framework, people and culture development and operational improvements.

While we’re already seeing good outcomes from these investments, costs have been increasing over the past few years due to:

- Inflationary pressures

- The continued increase in the complexity and scope of regulation to meet international standards

- Supporting current and future international evaluations

- The need to ensure adequate team capacity and capability for the Moneyval assessment, and to remain competitive in a candidate-led job market, which has increased our employee cost base by over 15% over the past two years

- Increased building and technology costs

Wherever possible, we have implemented enhancements to our existing buildings and technology through investment in our core infrastructure. While we have made progress on the technology front, our building is now not fit for purpose and incremental improvements are no longer a viable option. We therefore need to move to new office premises which are modest, appropriate and effective.

To manage the potential impact on fee levels of the required building move, we will be transferring a proportion of our financial resilience reserve to a dedicated building reserve. This will provide the funding required while minimising the potential for one-off fee increases.

Our budget is consistent with our retained liquid assets policy. We will remain well above our minimum threshold and anticipate we will remain in line with our target level through to 2027.

Financials overview

|

2023 forecast £'000 |

2024 projected £'000 |

Variance between 2023 forecast and 2024 projected £'000 |

|

| Regulatory fees | 20,535 | 22,722 | 2,187 |

| Registry fees | 7,243 | 6,801 | (442) |

| Other income | 817 | 771 | (46) |

| Total income | 28,595 | 30,294 | 1,699 |

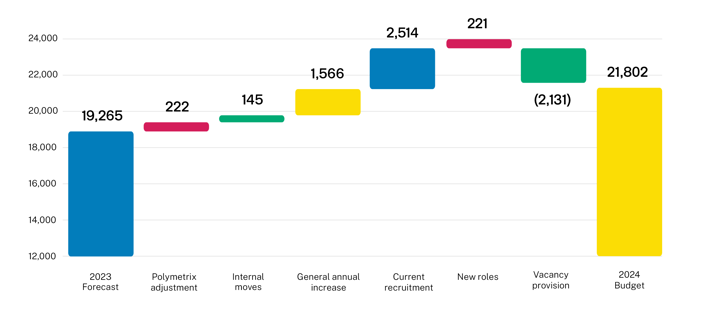

| Staff costs | 19,265 | 21,802 | 2,537 |

| Computer systems | 2,401 | 3,283 | 882 |

| Other operating costs | 6,565 | 6,037 | (528) |

| Total operating expenses | 28,231 | 31,122 | 2891 |

| Depreciation | 1,551 | 1,506 | (45) |

| Retained profit / (loss) | (1,187) | (2,334) | (1,147) |

| B/fwd Retained liquid assets | 12,564 | ||

| Allocation to building fund | (3,000) | ||

| Operating cash flow | (1,156) | ||

| Capital investment costs | (276) | ||

| C/fwd Retained liquid assets | 8,132 |

Regulatory income

The amount of additional funding we need in 2024 to support our enhanced regulatory remit, employee retention and to reach our target headcount, is not anticipated to exceed a relevant estimated RPI level, as we will make use of our retained liquid asset position. We will continue to pre-fund new regimes and provide for capital investments by deploying retained funds, including initiatives to improve operational efficiencies in the medium-term. In 2023 we commenced a fee review, and the external report is due to be completed in H1 2024. We have committed to completing the review in 2024, and we will use its findings to reassess the timing and methodology of future fees.

The below figures show forecast fee income, including movements in transactional volumes from industry sectors, compared to 2024 projected fee income:

|

2023 forecast £'000 |

2024 projected £'000 |

Movement £'000 |

Projected fee increase effect date | |

| Banking | 2,479 | 3,030 | 551 | December 2024 |

| Investment Business | 1,813 | 1,948 | 135 | May 2024 |

| Insurance Business* | 1,184 | 1,248 | 64 | October 2024 |

| Funds and Funds Business | 8,984 | 9,704 | 720 | July 2024 |

| Trust Company Business | 4,520 | 4,161 | (359) | January 2025 |

| Other businesses** | 1,555 | 2,631 | 1,076 | Various from June 2024 |

| 20,535 | 22,722 | 2,187 |

*Insurance Business includes General Insurance Mediation Business

**Other businesses - Designated Non-Financial Businesses and Professions, Money Services Business, and Recognised Auditors

Registry income

Registry income from annual confirmation fees is anticipated to rise by net £713,000 in 2024 as a direct result of the increase applied on 1 January. This is anticipated to be offset by a reduction in transactional fees driven by lower volumes of late fees being incurred, however the total projected income remains in line with expectations to fund ongoing

Registry operations.

The table below provides further details on the composition of Registry fee income:

|

2023 forecast £'000 |

2024 projected £'000 |

Variance between 2023 forecast and 2024 projected £'000 |

|

| Annual confirmation fees | 4,280 | 4,993 | 713 |

| Transactional fees | 2,963 | 1,808 | (1,155) |

| 7,243 | 6,801 | (442) |

Operating costs

Operating costs are planned to increase in 2024 to ensure our continued investment in people, processes, and technology to support regulatory effectiveness.

Computer system cost increases are being driven by additional licence fees as employee levels rise, and by new Registry

and Supervisory systems moving out of capital investment phases. An element of the 2024 increase has been generated by the reallocation of certain support costs that were previously classified as other operational costs. The effect on the other operational costs is a year-on-year reduction.

Employee levels are increasing from an average of 223 in 2023 to an anticipated average of 256 in 2024. The average cost per head will rise by 8.9% owing to pay increases associated with rising living costs, but overall, the rise in the employee costs is below the rate of inflation due to a changing mix of personnel and associated pay grades.

The employee costs below illustrate the key drivers for the overall cost increase. The current recruitment column includes open recruitment roles and those under offer or accepted that have start dates due in 2024:

The operating costs breakdown is shown in the table below:

Capital investment

Our capital investment programme in 2024 supports the delivery of our strategic core workstreams. Most costs are linked to investment in technology, with continued migration of our core infrastructure to a secure cloud environment. We will also be investing in continuous improvements to our core supervisory systems to further enhance operational efficiency and resilience.

Thank you for your feedback.

To help us improve, tell us more about your visit today. Please fill in this short feedback survey.

This website uses cookies to analyse our traffic. To find out more read our cookie policy.