Service notice –Testing testing

Tackling the financial crime threat

One of our core focuses in 2020 was to strengthen our effectiveness at fighting financial crime and play our part in securing the best MONEYVAL assessment possible for Jersey, now scheduled for the first half of 2023.

To fulfil our commitment, 2020 marked the cementing of a major programme of work - the Financial Crime Prevention Capability Programme. Designed to review and improve every aspect of our work to fight financial crime, it covers the skills of our people, the legislation and arrangements we have in place, and the systems to collate data on how effectively we respond. It has the single aim of making us a valuable part of Jersey’s fight against financial crime so we maintain the Island’s reputation as an IFC.

During 2020, we restructured this programme around three key areas: preparing for our MONEYVAL inspection, ensuring we remain technically compliant, and demonstrating we are an effective regulator. In pursuit of the latter, in 2020 we undertook a detailed review of our current supervisory effectiveness, which resulted in some recommendations that we will implement in 2021. To supplement this work, we made improvements to the way we collect and report on data. We also upgraded the work management system used by our Enforcement team to ensure that they can capture elements of financial crime data more efficiently.

Towards the end of the year, we engaged with the Government and other local agencies on the new framework for Jersey’s Financial Crime Strategy, coordinating our approach to financial crime at an island-wide level. We also worked closely with the Government on a number of legislative amendments which include the Money Laundering Order and virtual asset service providers.

We engaged regulatory consultant Helen Hatton to lead Industry working groups to assess the risks of current exemptions, which will likely result in changes to existing legislation and our regulatory framework in 2022. We also asked Industry for feedback on proposed changes to the AML/CFT Handbooks so we can align our regime with the FATF Recommendations. These changes come into effect in 2021.

To ensure key members of staff are appropriately trained in financial crime matters, we developed an e-learning module for all staff and an intermediate level in-house training programme covering topics including sanctions, bribery and corruption, KYC and customer due diligence.

We started a targeted and extensive programme of Industry engagement focusing on financial crime and specific areas of risk. We set up dedicated pages on our website to upskill Industry and make them aware of what they need to be focusing on to ensure they are compliant.

National Risk Assessment

A significant element of our work to fight financial crime over the past few years has been our contribution to Jersey’s first National Risk Assessment (NRA) for money laundering. This work culminated at the end of September when the Government of Jersey published the assessment. It documented what we already recognised to be the potential risks, threats and vulnerabilities facing the Island, and we were already focusing our resources in these areas.

Following the publication, we hosted a series of webinars, led by our International and Industry Engagement Coordinator, to cover the findings and recommendations of the Government’s report. During the year, we also supported Government to finalise the NRA on terrorist financing to be published in early 2021.

Adapting to virtual examinations

As part of our programme to become even more effective supervisors and to improve our regulatory framework, we committed to undertaking an increasing number of examinations.

In 2020, our main, and not insignificant, hurdle was not being able to visit businesses to conduct the on-site element of our reviews. However, we overcame this by being one of very few jurisdictions to move to remote examinations. This meant a comprehensive revision of our processes and timetable, as well as issuing interim guidance to Industry.

During the year, we carried out a total of 58 different examinations on 100 businesses, including an ambitious programme of financial crime compliance/focused reviews. 75% of these examinations were conducted remotely.

To explain our new approach to Industry, and also to share our programme findings, we delivered a number of webinars and published feedback on our website. We did identify a trend of repeat findings so will keep this under review as part of our ongoing examination programmes for 2021.

Improving how we licence businesses

During the year, we commissioned an independent review of our authorisations framework – the way we grant and revoke licences for businesses and individuals. Our decision to do this was driven by our commitment to continually improve how we operate. We recognise the need to adapt our approach to keep up with the changes we are making to how we supervise, and the changes we are seeing in innovation in the finance industry. These improvements form part of our wider programme of organisational improvements set out in our four-year strategic roadmap. The review made some positive recommendations, which we have already started to action and will continue to do throughout 2021 to bring us in line with best international practices.

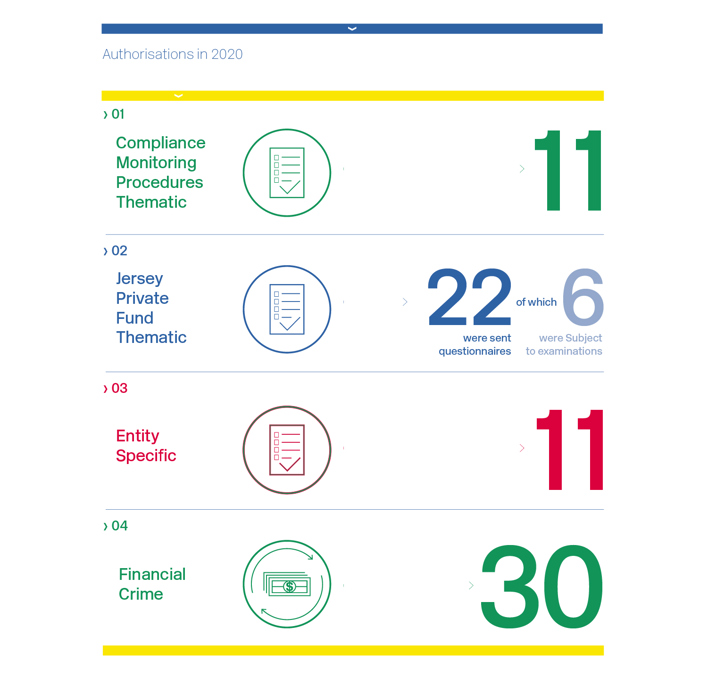

Authorisations in 2020

Thank you for your feedback.

To help us improve, tell us more about your visit today. Please fill in this short feedback survey.

This website uses cookies to analyse our traffic. To find out more read our cookie policy.