Service notice –Testing testing

Constitution

We are a statutory body established under Article 2 of the Financial Services Commission (Jersey) Law 1998 (FSC(J)L) which provides that the JFSC shall be governed by a Board of Commissioners comprising persons with financial services experience, regular users of such services and persons representing the public interest.

Accountability arrangements

We are an independent body, accountable to the public through the Island’s elected representatives namely the Minister of External Relations and the Government of Jersey. Our relationship with ministers is set out in a Memorandum of Understanding to ensure our independence, whilst facilitating effective dialogue and working practices. Article 12 of the Commission Law provides that the Minister may give the JFSC general directions, subject to significant safeguards.

In 2017, an Article 12 Direction was issued in order for the Exchange of Information on Beneficial Ownership (BO) agreement with the UK to be implemented to allow the Island’s Joint Financial Crimes Unit (JFCU) to access our relevant information and databases on beneficial ownership. The intention is that the Direction will be withdrawn once appropriate substitute legislation has been enacted.

We produce an annual business plan, and separately an annual report, to inform Members of the States Assembly and other stakeholders. We consult extensively on all proposals to create or amend laws and regulations, and we provide feedback statements to explain how we have taken responses into account.

Governance arrangements

Our Board of Commissioners believes that high quality effective governance arrangements are essential for well-run organisations. There are no comprehensive Codes or Standards for the governance of a financial services regulator, but the Board believes that the UK Corporate Governance Code (Code) is an appropriate benchmark. The Code requires Boards to comply with its high-level principles or explain how the objectives behind those high-level principles have been met through other arrangements.

We comply with the vast majority of the high-level principles in the Code. For example, we ensure there is a clear division of responsibility between the Chair and the Director General, that no individual has unfettered decision-making powers and that we have transparent procedures for the appointment and re-appointment of Commissioners.

Engagement with our workforce

The JFSC continues to observe the Corporate Governance Code issued by the UK and notes the changes regarding improving stakeholder engagement, including that of the workforce. We are considering ways in which we can incorporate these changes into our governance structure.

Several Commissioners spent time engaging with the JFSC workforce during 2019, including Commissioner O’Keefe who held a panel session regarding her experience of, and in, the finance industry.

Delegation of powers

Our Board delegates its powers to the Director General and the Executive where possible to ensure that the JFSC can act and respond without undue delay. However, in some areas, the power of the Commissioners to delegate is restricted by legislation. For example, our Board acts in a similar manner to a tribunal for contested enforcement cases. Consequently our Board is more involved in some areas of detail than the Board of a listed or private company. You can find a full explanation about our ‘Delegation of Powers’ on our website.

Composition of the Board and appointment of Commissioners

Our Board currently consists of the Chair, Deputy Chair and eight other Commissioners, including the Director General. All of the Commissioners are considered to be independent with the exception of the Director General. A chart of our current Commissioners is set out on pages 90-91 of this annual report and you can find further information on their skills, knowledge and experience on our website.

Board activities

The majority of our Board’s time in 2019 was spent on succession planning, strategy, recruitment, MONEYVAL and enforcement matters.

Recruitment of Chair

In mid-2018, our Board reviewed and reconfirmed the requirements for the role of Chair, in particular the continued necessity to appoint a Chair with strong links to UK and EU financial services policy makers at both political and executive levels.

Working with the Government and the Jersey Appointments Commission, it was agreed that we would search for a new off-island Commissioner who could be appointed future Chair, if supported by the Board, without incurring the costs of a further recruitment exercise.

Our Board was pleased to appoint Mark Hoban as Commissioner in late 2018 and delighted that in October 2019 the Commissioners were able to unanimously recommend to the Minister his appointment to replace Lord Eatwell, whose fixed term of office ended in April 2020.

Mark’s first Chair's statement is set out on pages 08-09.

Recruitment of other Commissioners

Commissioners Ruetimann and Whelan complete their fixed terms in 2020. Our Board is seeking to recruit new Commissioners with the necessary skills and experience to complement those of the current Commissioners.

Commissioners Morris and Pichler were re-appointed for a final four-year term on 21 January 2020.

Recruitment of new Director General

Our Board spent significant time during the latter part of 2018 and early 2019 clarifying the role of the Director General, refining the job description and then conducting a search. Martin Moloney was appointed as our new Director General and an ex-officio Commissioner in February 2019. His Director General’s report is set out on pages 12-13.

Strategy

Our Board, Director General and senior executives reconsidered the organisation’s long-term strategy at an annual away day. We undertook a lot of work to understand our true capacity and what we could realistically undertake year on year. We published our four-year strategy as a formal document and presented it, with our annual business plan, to Industry in February 2020. Feedback received at our annual business plan event was positive.

Responding to MONEYVAL

Planning for Jersey’s next MONEYVAL evaluation dominated many of the Board meetings during the year. The Island has historically been successful in implementing the FATF Recommendations as they have been developed. However, these FATF Recommendations and associated compliance assessment methodology have been revised, necessitating difficult decisions about the extent and cost of resources necessarily devoted to anti-money laundering and countering the financing of terrorism. Our Board reaffirmed its commitment to being ‘best in class’ in meeting the demands of the FATF Recommendations and the next assessment, recognising that the consequent staff and IT costs will be a significant additional burden.

Enforcement matters

Our Board spent significant time developing, consulting and implementing its methodology for determining the amount of civil penalties that it may apply for significant and material contraventions of the Codes of Practice. The principles are established in Law, but the methodology sets out how the JFSC plans to interpret those requirements to ensure that final amounts are proportionate and replicable on a consistent basis. Our Board has reserved the right to agree the amount of any penalty and has spent time considering the facts and then applying the principles to a significant case.

Our Board also spent significant time on a number of enforcement matters that arose through the application of the JFSC’s Decision Making Process. These cases tend to be highly complex and involve the actions of regulated persons over a considerable period.

The Commissioners also focused their attention on improving the Board's consistency for dealing with applications to vary directions. From time to time, our Board issues directions on regulated businesses and individuals, which may restrict their activities or ability to apply for a job in the finance industry without our prior permission. Such individuals retain the right at any time to apply to the Board for a variation in those directions, for example where they have conducted a period of retraining or heightened supervision.

Activities of the Board Committees

Our Board delegates certain areas to Board Committees. During the year, the Commissioners agreed to the creation of a Risk Committee to increase the focus and support on the JFSC’s risk management function.

No significant changes were made to the terms of reference of the Audit, Legal Proceedings, and Remuneration Committees.

Audit Committee

The Terms of Reference for the Audit Committee are available on our website. Its principal activities are to monitor the Internal Control Systems and work with the Executive and the External Auditors to ensure the quality of the management financial reports and the annual accounts.

In 2019, Commissioner Wright chaired the committee with members Crown Advocate Cyril Whelan and Peter Pichler.

The committee has appropriate financial and other experience. Ian Wright is a Qualified chartered accountant (FCA) and a former Senior Partner of PricewaterhouseCoopers. Cyril Whelan is a Crown Advocate and currently Senior Consultant at Baker & Partners, Peter Pichler is a Qualified chartered accountant (FCA) and a former Finance Director.

The committee met three times during 2019 and all members were present, in person or by telephone, for each meeting. The committee reviewed the management accounts, the annual capital and revenue budgets, and the draft annual reports and accounts. It recommended the annual report and accounts and the auditors letter of representation to the Board for approval. It reconsidered the appointment and independence of the auditors and reviewed their reports at the completion of their audit work. The committee also discussed in detail a number of accounting issues including sums retained from the annual return fees not claimed by the Government.

Legal Proceedings Committee

The Legal Proceedings Committee terms of reference are set out on our website. Its role is to bring skills and experience to legal matters and potential litigation arising from enforcement cases. The committee considers whether the JFSC will initiate or defend any legal proceedings arising from any law under which the JFSC has statutory powers. The committee takes into account potential legal costs when making decisions.

In 2019, the committee was Chaired by Lord Eatwell and its members comprised Cyril Whelan who is a Crown Advocate and Monique O’Keefe who previously practiced as a solicitor in England and Australia.

The committee met once during 2019 and considered issues arising from a significant enforcement case. All members were present for each meeting.

Remuneration Committee

The committee's Terms of Reference are available on our website. The committee’s remit includes keeping under review the fees paid to the Chair and other commissioners and the pay and bonus arrangements for the Director General and Commission staff. Consistent with the UK Corporate Governance Code, the remit has extended in recent years to staff working conditions and welfare. Commissioner Annamaria Koerling is Chair of the Remuneration Committee, she is joined by Monique O’Keefe and Markus Ruetimann as members of the committee.

The committee met on four occasions during the year and all committee members attended the scheduled meetings, apart from one member being unavailable for one meeting. Certain members of the Executive and the Head of Human Resources attended the meetings as required. The remit of the committee, being broad, encompasses a wide range of remuneration and Human Resources functions and regular discussions were had regarding remuneration strategy.

One of the committee's principal functions is to approve the staff salary and bonus allocations for the year and this process took place in November 2019. Remuneration and bonus payments are awarded strictly by reference to performance and the committee was pleased to note high performance ratings for several individuals.

Risk Committee

During 2019, the Chair identified that insufficient progress was being made with the development of our thinking on risk and risk management. As a result, the Board agreed to form a Risk Committee. The terms of reference of the Risk Committee are published on our website.

Responsibility for risk and risk management remains with the full Board but the Risk Committee will oversee and guide the Executive risk unit as the organisation develops its risk-based supervision strategy. The Risk Committee advises and partners with the Executive to fulfil the Executive’s accountability to the Board regarding risk management.

The committee was chaired initially by Mark Hoban and its members include Peter Pichler and Tracy Garrad, all with a wealth of experience in risk management. From 23 April 2020, the Committee has been chaired by Tracy Garrad.

The Risk Committee met five times in 2019 and consolidated the existing risk management framework, setting a strategic direction for the risk function, and working with the Executive on the governance and development of the new risk model.

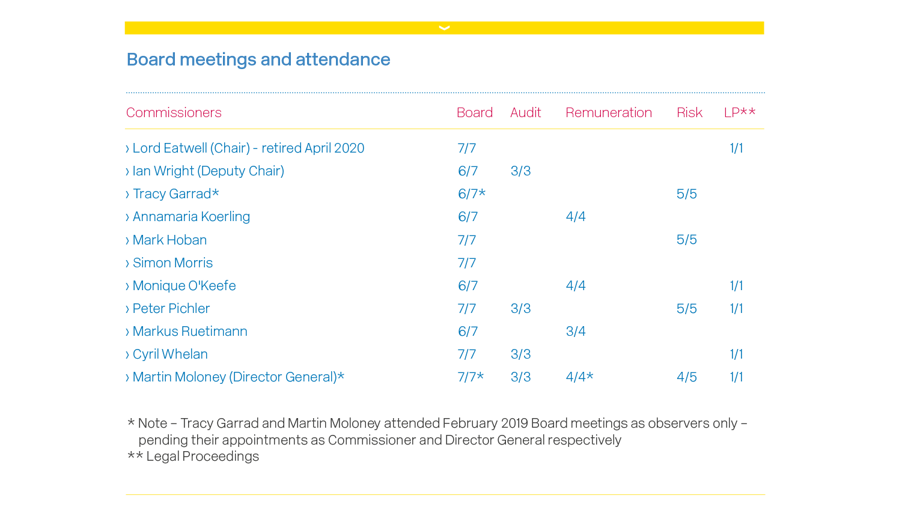

Our Board met seven times during 2019 to consider strategy, risk and regular business. Our Board also met several times in 2019 to review and consider enforcement settlement cases and contested matters. The Commissioners worked closely with the Executive Board on formulating the methodology for civil penalty cases.

In addition, the Board and the Executive met for a strategy day and also participated in events with fellow regulators, Industry representatives and Government ministers.

Regular discussions took place over the year with the Government in terms of significant financial services matters, the National Risk Assessment and Brexit preparations.

Board members consider carefully the potential for conflicts of interest to arise and excuse themselves if any perceived or actual conflicts are identified.

Board effectiveness review

The Board is committed to conducting regular Board effectiveness reviews. A review was not conducted during 2019. However, the Board issued a tender in January 2020 for an effectiveness review to be conducted by an external party soon after the appointment of the new Chair. We have awarded the review tender and interviews are underway.

Our Board reaffirmed its commitment to being ‘best in class’ in meeting the demands of the FATF Recommendations

Commissioner remuneration

Commissioners receive a fixed annual amount. No additional amounts are paid for participating or chairing subcommittees, dealing with enforcement cases or attending to other matters. Off-island

Commissioners receive an uplift in remuneration to account for additional burden of travel time and taxes.

Fees paid to Commissioners were not increased in 2019. The existing annual amounts will be reviewed following the pending external governance effectiveness review. 2019 was a busy year for Commissioners, several of them were engaged in a number of enforcement and other matters, on behalf of the JFSC. The Board noted, and thanked, Commissioners who had devoted significant time to JFSC matters.

Director General remuneration

Martin Moloney was not paid any fees in his capacity as a Commissioner but rather was paid as an Executive Director in his capacity as Director General. During the year, he received pro rata remuneration of £241,324 (fixed remuneration: £257,500, variable remuneration : £23,185).

Auditors

BDO LLP (the auditors) undertook the annual audit as approved by the Audit Committee in November 2019. The audit partner met with the Audit Committee at the planning stage of the 2019 audit to agree scope and areas of focus, and at completion stage to discuss audit findings.

Responsibility for annual report and accounts

This annual report and accounts comply with the requirement in the FSC(J)L to produce an annual report to the Chief Minister and to be presented to the Members of the States no later than seven months after the end of the financial year.

The statutory obligations on the Commissioners are not extensive, requiring only that the annual accounts shall be prepared in accordance with generally accepted accounting principles and show a true and fair view of the surplus or deficit for the period and state of affairs at the period end. The Commissioners have elected to prepare the financial statements in accordance with Financial Reporting Standard 102 (FRS102); the Financial Reporting Standard applicable in the United Kingdom and the Republic of Ireland.

Taking into account general practice, the Commissioners confirm that they are responsible for:

- Keeping adequate accounting records sufficient to show the financial position within a reasonable period of time

- Safeguarding the assets and for taking reasonable steps for the prevention and detection of fraud and other irregularities

- Preparing the financial statements in accordance with applicable laws and regulations

- Selecting suitable accounting policies and applying them consistently

- Making judgements and accounting estimates that are reasonable and prudent

- Preparing the accounts on a going concern basis unless it is inappropriate to presume that the JFSC will continue in business.

The Board has reviewed the effectiveness of the principal financial controls over its financial accounting systems with the external auditors.

The Commissioners have considered the financial statements on pages 70-87 and are satisfied that they show a true and fair view of the surplus for the year and the financial position of the JFSC at 31 December 2019.

The Commissioners have considered the annual report and, taken as a whole, confirm that they believe it to be fair, balanced and understandable.

------------------------------------------------------

For and on behalf of the Board of Commissioners

L Roe

Commission Secretary

5 June 2020

PO Box 267

14-18 Castle Street

St Helier

Jersey

Channel Islands

JE4 8TP

Thank you for your feedback.

To help us improve, tell us more about your visit today. Please fill in this short feedback survey.

This website uses cookies to analyse our traffic. To find out more read our cookie policy.