Service notice –Testing testing

Protecting consumers is at the heart of our work as the Island’s financial services regulator. In part, we do this through supervision, but we have other tools at our disposal including enforcement and education. This section sets out the work we undertook in 2019 in both of these areas.

Our Enforcement team witnesses first-hand the emotional journey that people go through when they learn that they have lost their money.

Targeting financial grooming

Sadly, the nature of the work we do means that we meet people who have lost some or all of their life savings. These investors have typically been mis-sold high-risk investments by independent financial advisers. In most instances, they are vulnerable, elderly, and alone. The majority are not financially sophisticated consumers, but ordinary people, and the impact of losing their money is life changing; both financially and emotionally.

In 2019, we identified a rogue independent financial adviser and managed to intervene just in time to prevent a pensioner from losing their life savings. Unfortunately, this case is one example of the type of financial grooming that we are increasingly seeing. For us, as the regulator, engaging with victims once they have been skilfully groomed presents unique challenges. Our Enforcement team witnesses first-hand the emotional journey that people go through when they learn that they have lost their money.

Consequently, we have started analysing cases where we identify that an Islander has been financially groomed. We have researched victim and perpetrator profiling, and identified red flags so we can spot this behaviour at its earliest stages. During 2019, we continued to collaborate with the States of Jersey Police and the Jersey Fraud Prevention Forum to build on our research and we will continue this work in 2020. In particular, we are looking at strengthening our regulatory rules and raising further public awareness, similar to the campaign we did in early 2017 to highlight investment mis-selling.

Taking action against misconduct

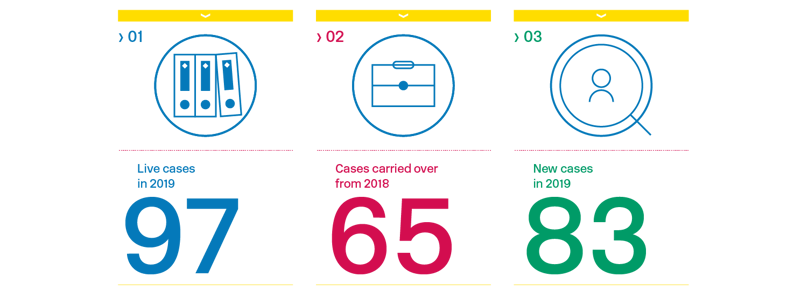

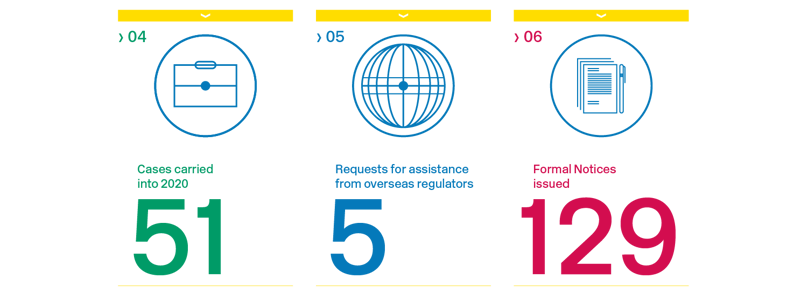

In addition to information shared by our supervisors, our intelligence function receives confidential leads from a variety of sources, including suspicious activity reports (SARs) submitted to the States of Jersey Police's Joint Financial Crimes Unit (JFCU).

In 2019, we received and successfully processed 372 SARs from the JFCU, up from 160 in 2018. We attribute this increase primarily to the revamped triage process we now have with the police and this reporting can only put our Supervision and Enforcement teams in a more informed position.

We verify the information we receive and, where appropriate, act upon it. In the most serious cases, vital intelligence has helped us to use our regulatory powers to protect some of the most vulnerable members of our community and to address significant business compliance failings that risk exposing Jersey to money laundering.

Using our powers to protect the public

During 2019, we imposed our first civil financial penalty on a regulated business. The £381,000 fine was for a serious and material contravention of our Codes of Practice, in relation to conflicts of interest, compliance and staff training on money laundering and record keeping. We simultaneously issued a public statement setting out the background to the penalty and sharing the lessons learned from this case.

Over the course of the year, we also issued four directions preventing individuals from fulfilling specific functions and directed a number of businesses to stop taking on any new business while they remediated regulatory shortcomings.

We also issued five public statements and resolved four enforcement cases through settlement agreements, which is a proportionate solution when a regulated business has acknowledged its shortcomings and made binding commitments to resolve them.

Working with other agencies to protect Islanders

Raising awareness is one of the main ways we can help to reduce the risk of members of the public losing money. Our most effective work is in collaboration with other island and overseas agencies.

Through our on-going financial education programme and targeted public awareness campaigns, we already reach a large proportion of the local community and schools.

Jersey Fraud Prevention Forum

Since 2015, we have played a significant role as a member of the Jersey Fraud Prevention Forum; a group of local agencies that have come together with the primary aim of raising awareness about frauds and scams to help protect the public.

In 2019, we issued public warnings in our newsletters and the media after a local man lost £1.2 million in a bitcoin scam and a number of other Islanders were conned out of more than £350,000 in separate cases of romance fraud.

At the end of the year, the Forum secured funding from the Jersey’s Criminal Offences Confiscation Fund, which will enable it to continue its valuable work helping to protect the Island community for the next three years.

World Investor Week

For the third year running, we supported IOSCO’s Word Investor Week - a week long, global campaign to raise awareness about the importance of investor education and protection.

One of 88 jurisdictions to take part, we arranged an array of activities, including a public drop-in session with the Channel Islands Financial Ombudsman and the Office of the Information Commissioner, and an interactive competition to engage local primary school pupils.

Educating our young people

JFSC schools programme

In addition to our supervisory and enforcement activity, during the year members of staff from across the organisation continued to contribute to our financial education work.

Supplementing the local curriculum, and working with other local agencies, we delivered financial literacy classes to more than 3,000 secondary school pupils over the course of 2019.

Our next step is to adapt and take our programme into primary schools so we engage at an early age with our youngest consumers.

Thank you for your feedback.

To help us improve, tell us more about your visit today. Please fill in this short feedback survey.

This website uses cookies to analyse our traffic. To find out more read our cookie policy.