Service notice –Testing testing

Basel III Prudential Roadmap

- Issued:25 March 2024

-

Basel III Prudential Roadmap

A roadmap for the implementation of Basel III in Jersey, including principles, timeline and signposting on key matters.

Feedback

The Jersey Financial Services Commission (JFSC) invites comments on the roadmap by 31 May 2024. If you require any assistance, clarification or wish to discuss any aspect of the proposal prior to formulating a response, it is of course appropriate to contact the JFSC.

The JFSC contact is:

David Fisher

Senior Adviser, Policy

Jersey Financial Services Commission

PO Box 267

14-18 Castle Street

St Helier

Jersey

JE4 8TP

Telephone:+44 (0) 1534 822106

Email: [email protected]

1 Executive summary

1.1 Overview

1.1.1 We are committed to meeting international standards. The Basel Committee has revised the international standard for prudential supervision of internationally active banks, the Basel Framework, through its package of reforms referred to as Basel III.

1.1.2 We are monitoring international developments, and the current expectation is that the EU is targeting adoption of the final set of reforms (often referred to as Basel 3.1 or Basel IV) from 1 January 2025, whilst the UK and US are unlikely to implement ahead of mid-2025.

1.1.3 Basel III builds on the current prudential requirements, delivering a framework for capital allocation that better reflects the risks. This is important in providing a stable framework that supports the provision of banking services to our island’s economy, Jersey consumers and Jersey financial services providers. We also need to take into account that our banks are part of large international banking groups that are subject to consolidated supervision that is increasingly moving towards Basel III.

1.1.4 We have already implemented several elements of the Basel III reforms, including capital definitions, short term liquidity requirements (the Liquidity Coverage Ratio or LCR) and reporting of the long-term liquidity position (the Net Stable Funding Ratio or NSFR) and reporting of the Leverage Ratio, a non-risk-based capital ratio.

1.1.5 This paper sets out a roadmap for the implementation of Basel III. Our proposed strategy is based around the following principles:

Using the UK’s implementation as the basis for our framework

Proportional, flexible and simple - adopting a regime which is pragmatic to implement, suitable for the banking business profiles we have in Jersey and can be operated efficiently within the capacity and resources of the JFSC and banks

Address competitive disadvantages - amending the UK’s framework to remove UK specific measures or those which may not enhance the competitiveness of Jersey as a jurisdiction without impairing the overall resilience of our banking system

1.1.6 The JRA is seeking to implement MREL requirements, addressing both the Bank (Recovery and Resolution) (Jersey) Law 2017 and international standards on bank resolution and we have added references to key dates for this JRA driven work to provide a comprehensive picture.

1.2 What is proposed and why?

1.2.1 This paper addresses our overall strategy for implementing Basel III, consistent with the principles set out in section 2, within the timeline set out in section 3 and, where relevant, the high-level signposting set out in section 4 and the related issues set out in section 5.

1.2.2 Further consultations will take place in due course, taking into account feedback received.

1.2.3 A consultation paper “Basel III: Immediate implementation” (Quick Wins CP) will be issued in Q1 2024 on proposals for the near-term implementation of certain quick wins, drawing on our 2021 Position Paper and industry feedback.

1.3 Dialogue

1.3.1 This Roadmap has been circulated by email to subsidiary banks, the Jersey Bankers Association (JBA), including the relevant JBA sub-committee, the JBA Prudential and Banking Reform Technical Group (JBARTG) and to the Government of Jersey.

1.3.2 Feedback is sought by the end of May 2024, including via meetings of the JBARTG and with each subsidiary bank.

1.3.3 It is then intended, amongst other things, to publish a revised version of the Basel III Prudential Roadmap (Sections 2 to 5 below) on our Basel III webpage – see Basel III — Jersey Financial Services Commission (jerseyfsc.org).

2 Principles

2.1 Principle 1: Using the UK implementation as the basis for our framework

2.1.1 The UK’s implementation of Basel III/3.1 is consistent with the international standard and many banks have links with the UK.

2.1.2 In the main, the EU and UK proposals are similar across both jurisdictions so implementation of the relevant parts of the standard in Jersey would be equivalent to both UK and EU.

2.1.3 The UK has however proposed some areas of divergence versus the EU and we propose applying those that seem reasonable in our context.

2.2 Principle 2: Proportional, flexible and simple

Differentiating between systemic banks with foreign operations and others

2.2.1 The UK and EU have implemented additional capital requirement buffers for systemic banks. Basel III’s stated scope is internationally active banks. It is therefore intended to apply proportionately more regulation to such banks (those where failure would be disruptive and those with material overseas operations) and less regulation for banks where failure would have a limited impact and where overseas operations are not material.

2.2.2 Detailed proposals will address which banks are captured, how regulations will be varied and in particular the respective scale of the capital buffers.

Liquidity requirements

2.2.3 The requirements in Basel III regarding short-term liquidity (the LCR) have already been implemented in Jersey and it is not intended to revisit this, other than to address some issues around the classification of liquid assets, as identified in the 2021 Position Paper, which will be addressed fully in the Quick Wins CP.

2.2.4 Basel III also includes a long-term Net Stable Funding Ratio (NSFR) requirement. Both the UK and the EU have implemented the NSFR but also provided simpler regimes for smaller banks. We propose to use prudential reporting to monitor the NSFR in all cases but only set a binding minimum for banks that are systemic or have material overseas operations.

Buffer structure and Pillar 2

2.2.5 We propose identifying banks that are systemic and to distinguish between those that give rise to the highest risk and require them to maintain a buffer that is proportional to the risk. This would be in addition to the Capital Conservation Buffer and any Pillar 2 buffer.

2.2.6 The JFSC intends to take our systemic risk assessment into account when determining the supervisory approach for a bank, including the depth and frequency of Pillar 2 review work.

2.2.7 The JFSC does not propose a framework for a countercyclical buffer (see section 5.1), this falling outside of our responsibility for micro-prudential supervision.

Example of capital minima and buffers required under existing regime and Basel III:

|

|

|

CET1 |

Tier 1 |

Total |

Buffer |

Total |

|||

|

Systemic bank |

Current |

8.5% |

8.5% |

10% |

2% |

12% |

|||

|

Basel III |

4.5% |

6% |

8% |

CCB: 2.5% |

Pillar 2: 1% |

Systemic: 1.5% |

13% |

||

|

Difference |

(4%) |

(2.5%) |

(2%) |

+3% |

+1% |

||||

|

Non-systemic bank |

Current |

8.5% |

8.5% |

10% |

1% |

11% |

|||

|

Basel III |

4.5% |

6% |

8% |

CCB: 2.5% |

Pillar 2: 0% |

Systemic: 0% |

10.5% |

||

|

Difference |

(4%) |

(2.5%) |

(2%) |

+1.5% |

(0.5%) |

||||

Leverage Ratio

2.2.8 Basel III also includes a Leverage Ratio requirement. As for the NSFR, we propose a simpler regime in the case of non-systemic banks with no material overseas operations. The JFSC will use prudential reporting to monitor the Leverage Ratio in all cases but only set a binding minimum for banks that are systemic or have overseas branches.

Market Risk, Counterparty Credit Risk and the Trading Book

2.2.9 Basel III rules around Market Risk, Counterparty Credit Risk and the Trading Book are very complex and relevant exposures for Jersey banks are and have been minimal. We propose retaining the existing simpler rules and use prudential reporting to monitor the risk; the JFSC could use Pillar 2 to address any emergent risk. Any fuller adoption would only be contemplated if banks developed Trading Books in Jersey or have consistently material exposures to Market or Counterparty Credit Risk.

Transition requirements

2.2.10 We aim to deliver a flexible implementation timetable which allows banks to transition early once ready or, at the latest, 12 months after the publication of the full set of rules, including those relating to prudential reporting.

2.2.11 Some elements have minimal operational or JFSC impact and can be implemented this year. These will be set out in the Quick Wins CP to be published in Q1 this year. A good example is aligning capital minima along with adding a capital conservation buffer.

2.2.12 By being proportionate and focusing on maters material to Jersey, the operational impact on banks and on the JFSC can be limited.

2.3 Principle 3: Address competitive disadvantages

2.3.1 In a limited number of areas, the UK proposals are disadvantageous to Jersey banks, particularly when compared with the requirements proposed in the EU. Two key examples are lending to SMEs and commercial mortgages. We can adapt our requirements so that Jersey banks are not disadvantaged when lending to the EU or indeed in Jersey.

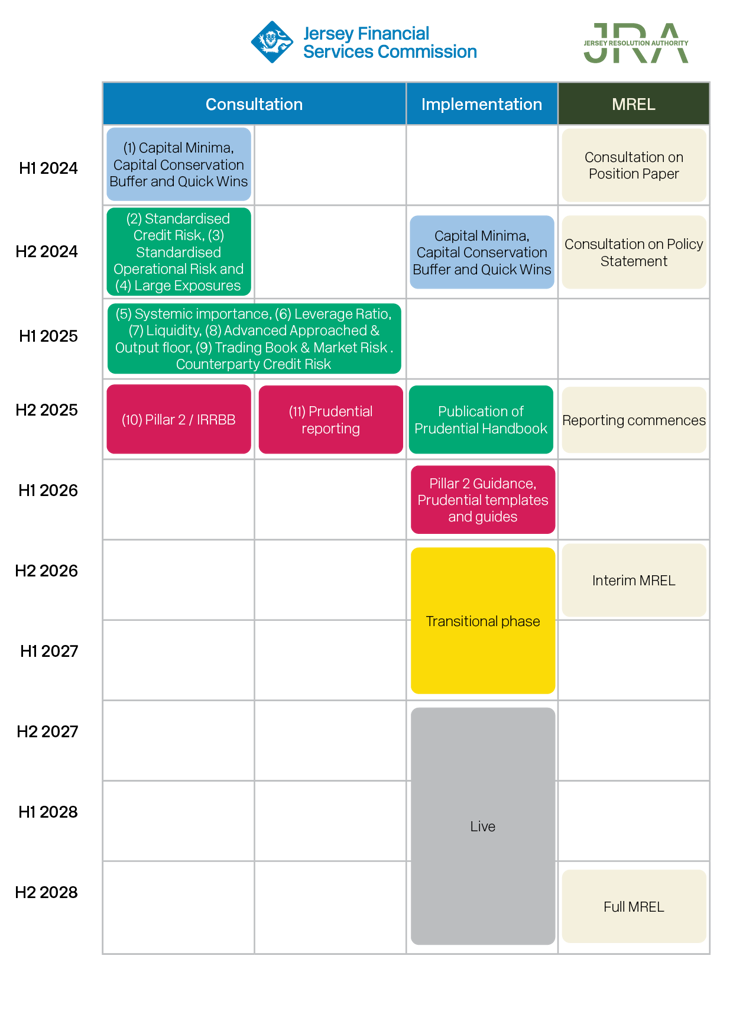

3 Timeline

4 Signposting

4.1 Capital minima, the Capital Conservation Buffer and Quick Wins CP

4.1.1 Broadly retain current definitions of capital.

4.1.2 Align capital minima with the Basel Framework.

4.1.3 Establish a Capital Conservation Buffer, at 2.5%.

4.1.4 Make adjustments to the LCR and Large Exposures regimes, in line with the 2021 Position Paper.

4.1.5 For full details, see the Quick Wins CP.

4.2 The standardised approach to credit risk

4.2.1 Follow UK position generally.

4.2.2 Consider adjusting UK position to ensure Jersey banks are not disadvantaged, including (but not limited to) SME exposures.

4.3 The standardised approach to operational risk

4.3.1 Follow UK position.

4.3.2 Consider loss data in Pillar 2.

4.4 Large Exposures

4.4.1 As per the Quick Wins CP, allow Concession Limits for PSEs and extend for short term government Bills and allow a revised treatment of reverse repos.

4.4.2 Follow the UK position generally.

4.4.3 Revise Concession Limits regime to work with UK position.

4.4.4 Develop Pillar 2 and prudential reporting to enable supervisory review.

4.5 Systemic importance

4.5.1 Implement buffers for systemic banks, differentiating (1) highly systemic banks (where continuity of services is essential) from (2) systemic banks (where disorderly cessation should be avoided) and both from (3) non-systemic, smaller banks.

4.5.2 Take into account when determining whether to apply leverage and NSFR minima, see below.

4.6 Leverage Ratio

4.6.1 Amend to reflect UK position for systemic banks and those with material overseas operations (exclude central bank reserves and mandate a minimum of 3.25%).

4.6.2 Carve out smaller, non-systemic banks with no material overseas operations. For such banks, only reporting and consideration of leverage in Pillar 2 would be required.

4.7 Liquidity

4.7.1 No change to LCR, other than as per the Quick Wins CP (principally regarding the classification of PSE and MDB holdings as liquid assets).

4.7.2 Impose a minimum NSFR of 100% for systemic banks and those with material overseas operations. Carve out smaller, non-systemic banks with no material overseas operations.

4.8 Advanced approaches and the output floor

4.8.1 Align with UK in permitting advanced approaches, including:

Implement UK-aligned regulations

No output floor for subsidiaries of overseas banks where group is subject to an output floor

4.9 Trading Book exposures, market risk and counterparty credit risk

4.9.1 Retain current simple regime for banks with minimal exposures.

4.9.2 Develop Pillar 2 and prudential reporting to address situations where exposures become material.

4.10 Pillar 2 and Interest Rate Risk in the Banking Book

4.10.1 Update the Pillar 2 Guidance Note, to take account of:

Our Supervisory experience

Other regulators’ implementations of Pillar 2

Industry feedback, in due course

Systemic importance

The need for development with respect to Advanced Approaches and Large Exposures

4.11 Prudential reporting

4.11.1 Build and develop from existing Excel templates and MyJFSC Portal process for submission.

4.11.2 Use UK templates as a starting point for new requirements, including regarding Large Exposures.

5 Related issues

5.1 Separation from international/local developments impacting banks

5.1.1 There are two areas where work driven by other agencies may impact banks, as set out below, but which are separate to our implementation of Basel III for Jersey.

5.1.2 The Jersey Resolution Authority (JRA) has set out proposals to impose Minimum Requirements for own Funds and Eligible Liabilities (MREL). These capital requirements will apply for the largest, most systemic banks. We will work with the JRA on the implementation of Basel III capital requirements and the MREL requirements on Jersey banks.

5.1.3 The Government of Jersey leads on consideration of macro-economic risks and has appointed the Fiscal Policy Panel as a shadow Financial Stability Board. The JFSC will work within the framework set out by the Government of Jersey for financial stability.

5.2 Emergent risks

5.2.1 We are aware that the Basel Committee and international regulators are considering the impact of new and emergent risks such as digitalisation, financial risks relating to climate change and the holding of crypto-assets, including tokenisation of financial assets and stablecoins.

5.2.2 We will consider our reaction to any international standards regarding the above and the risks to which they relate when conducting relevant consultations.

5.3 Regulatory technology

5.3.1 We will revise our prudential reporting forms and submission processes to support the supervision of banks under Basel III.

5.3.2 Further use of the myJFSC Portal will be considered for related matters, such as Large Exposures notifications.

5.4 Costs and fees

5.4.1 The JFSC has explained previously[1], any particular costs relating to the regulation of advanced approaches may be recovered from banks using advanced approaches.

[1] See Consultation on banking fees no 8 2023 — Jersey Financial Services Commission (jerseyfsc.org)

Thank you for your feedback.

To help us improve, tell us more about your visit today. Please fill in this short feedback survey.

This website uses cookies to analyse our traffic. To find out more read our cookie policy.