Service notice –Testing testing

Guidelines on interpretation of Article 36 of the Proceeds of Crime (Jersey) Law 1999

- Issued:30 January 2023

- Last revised:02 October 2024

-

Guidelines on interpretation of Article 36 of the Proceeds of Crime (Jersey) Law 1999

Glossary

|

Term |

Definition |

|

AML |

Anti-money laundering. |

|

AML/CFT/CPF Handbook |

Handbook for the prevention and detection of money laundering, the countering of terrorist financing, and the countering of proliferation financing. May also be referred to as “the Handbook” or “this Handbook”. |

|

AML/CFT/CPF regime |

“anti-money laundering and counter-terrorism legislation” as defined at Article 3(1) of the Supervisory Bodies Law, and the Handbook. |

|

CFT |

Countering proliferation financing |

|

conduct of business and prudential regulatory laws |

Alternative Investment Funds (Jersey) Regulations 2012 Banking Business (Jersey) Law 1991 Collective Investment Funds (Jersey) Law 1988 Financial Services (Jersey) Law 1998 Insurance Business (Jersey) Law 1996 |

|

CPF |

Countering proliferation financing |

|

DNFBP |

Designated Non-Financial Business or Profession as defined in the FATF glossary. Refers to activities/operations specified in Part 3 of Schedule 2 to the Proceeds of Crime Law. |

|

FATF |

Financial Action Task Force. |

|

FATF Methodology |

FATF Methodology for Assessing Technical Compliance with the FATF Recommendations and Effective of AML/CFT/CPF Systems. |

|

FATF Recommendations |

FATF International Standards on Combating Money Laundering and the Financing of Terrorism & Proliferation. |

|

FATF Standards |

FATF Recommendations, and FATF Methodology. |

|

Financial Institution |

As defined in the FATF glossary. Refers to activities/operations specified in Part 2 of Schedule 2 to the Proceeds of Crime Law. May be referred to as FI. |

|

financial services business |

Activities and operations specified by Schedule 2 conducted as a business. |

|

Industry |

Collectively, all businesses operating in or from within Jersey. |

|

JFSC |

Jersey Financial Services Commission (abbreviated in relevant Jersey legislation as “the Commission”). |

|

Money Laundering Order |

Money Laundering (Jersey) Order 2008. |

|

MVTS |

Money or Value Transfer Services Money or Value Transfer Services. Has the meaning given in paragraph 5 of Part 2 of Schedule 2 to the Proceeds of Crime Law. |

|

Non-Professional Trustee |

Means a person acting, otherwise than by way of business, as trustee of an express trust as referred to in Paragraph 25 of Part 5 of Schedule 2 to the Proceeds of Crime Law. |

|

NPTO |

Proceeds of Crime (Duties of Non-Professional Trustees) (Jersey) Order 2016. |

|

person |

A natural or legal person and where relevant includes a person acting as governing body in relation to a legal arrangement (see 3.4). |

|

Private Trust Company |

Means a trust company that has notified the JFSC that it is providing the service that is exempt from prudential and conduct regulation under the Financial Services (Jersey) Law 1998 under paragraphs 4 and 4A, Part 1 of the schedule of Financial Services (Trust Company Business (Exemptions)) (Jersey) Order 2000. |

|

Proceeds of Crime Law |

Proceeds of Crime (Jersey) Law 1999. |

|

Supervisory Bodies Law |

Proceeds of Crime (Supervisory Bodies) (Jersey) Law 2008. |

|

Schedule 2 |

second schedule to the Proceeds of Crime Law. |

|

Schedule 2 business |

has the meaning given in Article 1 of the Proceeds of Crime (Supervisory Bodies) (Jersey) Law. |

|

supervised person |

For the purposes of these Guidelines, a person required to register with the JFSC for the conduct of financial services business. |

|

VASP |

Virtual Asset Service Provider. |

1 Overview

1.1 General approach

1.1.1 The activities and operations specified within the second schedule (Schedule 2) to the Proceeds of Crime (Jersey) Law 1999 (Proceeds of Crime Law) are broad ranging. Those considering whether their activities and operations fall within this broad range of specified activities and operations should adopt an approach that prefers inclusion over exclusion.

1.1.2 Where there is doubt, persons are encouraged to contact the JFSC to discuss their circumstances.

1.1.3 A person that fails to register as a Schedule 2 business then carries on unauthorised Schedule 2 business may be found to be in contravention of Article 10 of the Proceeds of Crime (Supervisory Bodies) (Jersey) Law 2008 (Supervisory Bodies Law) which is an offence carrying liability to imprisonment for a maximum term of 7 years and a fine.

1.2 Proceeds of Crime (Jersey) Law 1999

1.2.1 These guidelines are issued pursuant to Article 36(2) of Proceeds of Crime Law under which the JFSC may issue guidelines on the interpretation of the expression “when conducted as a business” or of any provision in Schedule 2, including any expression used in Schedule 2.

1.2.2 Regard must be given to these guidelines when interpreting the expression “conducted as a business”, or any expression in Schedule 2.

1.2.3 In interpreting the expression “conducted as a business”, and those used in Schedule 2, the JFSC has taken account of the meaning given to those expressions in:

1.2.3.1 Financial Action Task Force (FATF) International Standards on Combating Money Laundering and the Financing of Terrorism & Proliferation – the FATF Recommendations as updated from time to time or

1.2.3.2 the FATF Methodology for Assessing Technical Compliance with the FATF Recommendations and Effective of AML/CFT/CPF Systems, as updated from time to time.

Together referred to in this document at the FATF Standards.

1.2.4 Account must always be taken of the meaning, if any, given to the expression in the FATF Standards. The FATF Standards are not prescriptive and subjective interpretation will be required regarding an assessment of whether and activity or operation is in scope, noting the guidance given in 1.1.1 above.

1.3 Article 36 and Schedule 2

1.3.1 Article 36(1) of the Proceeds of Crime Law provides that “Schedule 2 has effect to specify the activities and operations which when conducted as a business constitute financial services business for the purposes of this Law.”

1.3.2 This is a high-level filter that determines if an activity or operation is included, or excluded, from the definition of financial services business under the Proceeds of Crime Law.

1.3.3 There are two obvious issues that may arise when considering if a person’s activities or operations are within scope of Article 36(1) and, as such are a financial services business:

1.3.3.1 Are they conducting “activities or operations” specified in Schedule 2 and

1.3.3.2 Are those activities “conducted as a business”?

1.3.4 The two aspects are not wholly separate. There are some activities where acting as a business is almost inherent; and some where it is not. It is difficult to undertake activity that would be recognised as banking and not be a business. However, many people lend money (even at interest) without any suggestion of being in business.

1.3.5 The first aspect (1.3.3.1) is considered by reference to Schedule 2, and supported by Section 3 which features the guidelines on interpretation that the JFSC has issued under Article 36(2).

1.3.6 Consideration of the second aspect (1.3.3.2) is supported by Section 2 which provides guidelines on the consideration of “conducted as a business” by reference to the FATF Standards.

1.3.7 Except for Non-Professional Trustees (Schedule 2, Part 5, Paragraph 25), it is necessary to be conducting the financial services business operations and activities as a business in order for a person’s activities and operations to cause a person to be within scope of Article 36(1) of the Proceeds of Crime Law.

1.4 Registration as a Schedule 2 business with the JFSC

1.4.1 Registration as a Schedule 2 business is required, by virtue of the Supervisory Bodies Law, for all persons that meet the criteria at Section 1.3.3. This includes persons that are otherwise provided exemptions from registration under the conduct of business and prudential regulatory Laws (see glossary).

1.4.2 If having considered both aspects detailed at 1.3.3 a person concludes that they are, a financial services business, except if they are a Non-Professional Trustee, they are required to register with the JFSC under the Supervisory Bodies Law, and will become a supervised person, subject to the provisions of Jersey’s AML/CFT/CPF regime including the Proceeds of Crime Law 1999, Money Laundering Order (Money Laundering Order, where a supervised person is referred to as a “relevant person”), and the JFSC’s Handbook for the prevention and detection of money laundering, the countering of terrorist financing and the countering of proliferation financing (Handbook).

1.4.3 A financial services business that is a Non-Professional Trustee to an Express Trust will not meet the second aspect (1.3.3.2). However, Article 36 and Paragraph 25, within Part 5 of Schedule 2 provide that Non-Professional Trustees are financial services business for the purpose of the Proceeds of Crime Law. As such, Non-Professional Trustees are subject to relevant obligations under Jersey’s AML/CF/CPF regime as modified by the Proceeds of Crime (Duties of Non-Professional Trustees) (Jersey) Order 2016 (NPTO). Non-Professional Trustees are not required to register with the JFSC.

1.4.4 When registering with the JFSC, and on an ongoing basis, a Schedule 2 business must specify all activities and operations that it conducts as a business in order that the JFSC is able to maintain an accurate understanding of relevant activities and operations conducted in or from within Jersey. This supports the JFSC in using a risk-based approach in accordance with Article 8A of the Supervisory Bodies Law.

1.4.5 A person that is conducting more than one activity or operation within Schedule 2 will need to consider if there any different requirements that apply to the relevant activities they undertake.

2 Guidelines on the interpretation of Conducted as a business

2.1 Conducted as a business

2.1.1 Whether or not an activity is conducted as a business can be a qualitative matter, and thus requires an element of subjective judgement. In this regard, neither the FATF Standards, nor Jersey’s laws are prescriptive. The JFSC has long-recognised that this is an area in which principles-based guidance can be helpful to Industry in respect of conduct of business and prudential matters. This section provides guidelines specifically in respect of Schedule 2 activities and operations.

2.1.2 A person conducting activities and operations specified in Schedule 2 will make their own determination regarding whether or not they do so as a business. However, as they carefully consider their circumstances, they may use the below guidelines to support their considerations.

2.1.3 The guidelines in this Section (2) are not prescriptive on whether an activity or operation is, or is not, conducted as a business. However, the greater the number of indicators at 2.1.4 that a person meets, the greater the chance that they are conducting activities or operations as a business. If, on balance, a person remains unsure whether they are conducting an activity or operation as a business they are encouraged to discuss their specific circumstances with the JFSC.

2.1.4 Indicators that a person is conducting an activity or operation as a business include:

2.1.4.1 The person holds out or publicly offers to conduct the activity or operation for other persons

2.1.4.2 The activity or operation is conducted for commercial purposes with the intention of earning a profit through receipt of compensation, including non- financial benefits/benefits in kind

2.1.4.3 The level of financial compensation however received (both in terms of the quantum and as a proportion of the person’s total income) from the activity or operation is significant

2.1.4.4 The person conducts more than one type of Schedule 2 activity

2.1.4.5 The person conducts the activities or operations for more than one other person

2.1.4.6 The person conducting the activity is not doing so in a way where the activity could be fairly described as a hobby or amateur interest or

2.1.4.7 The person conducts the activities or operations with a view to making a profit, including where the intention is for the profit to come to someone else such as another group company.

2.1.5 The indicators included in paragraph 2.1.4 represent a non-exhaustive list of considerations.

2.1.6 If a person has judged themselves to be acting by way of business and is relying on an exemption from having to register under the conduct of business and prudential regulatory laws, this may be an indicator they are conducting an activity as a business. For example, lawyers and accountants and other professions and businesses who rely on an exemption from trust company business under the prudential and conduct regulatory laws will need to consider if their trust company business activities are now in scope. However, the relevant indicators for whether or not a person is conducting a particular activity or operation as a business, may differ depending on the activity or operation being conducted.

2.1.7 Indicators that a person is not conducting an activity or operation as a business include, but are not limited to:

2.1.7.1 The person does not receive any form of compensation however received, financial or otherwise, when conducting the activity or operation; or

2.1.7.2 The person conducts the activity or operation in an honorary, recreational or charitable capacity.

2.1.8 In addition to the above, when a person is determining whether or not they are conducting an activity or operation as a business, it is relevant for them to consider whether they are doing the activity or operation for or on behalf of a customer (in the context of FI activities and operations) or another person (in the context of VASPs) or providing a service to third parties (in the context of DNFBPs). Further detail on this is included in the following sections.

2.2 Financial Institutions (FI)

2.2.1 FIs are described in Part 2 of Schedule 2 of the Proceeds of Crime (Jersey) Law 1999.

2.2.2 The FATF Standards define FI (Schedule 2, Part 2) as:

2.2.2.1 FI means any natural or legal person who conducts as a business one or more of the following activities or operations for or on behalf of a customer […].

2.2.3 Determining whether an activity or operation is within the definition of FI features the following three aspects:

2.2.3.1 Conducts relevant activities or operations

2.2.3.2 Does so “as a business” and

2.2.3.3 Does so for or on behalf of a customer.

2.2.4 The first two of these aspects are the same as described at Section 1.3.

2.2.5 The third aspect requires that the activity or operation that is conducted as a business needs to be for or on behalf of a customer. Without the activity or operation being performed for or on behalf of a customer, it would not be considered a FI activity or operation and so would be excluded.

2.2.6 “Customer” is a broad concept and consideration includes where a person receives, or will receive in the future, any form of compensation however received, financial, or otherwise) for conducting an activity or operation for or on behalf of another person. In most circumstances (see 2.2.10) that other person would be a customer.

2.2.7 However, customer implies someone with whom a person is “doing business”. If two persons together form a business, they may enter into agreements as to how that business is carried out, and what payments should pass between them. That would not normally be thought of as each carrying on a separate business with the other as a customer; the more natural way of viewing it would be that they are each part of a business. The business that they carry on together would be the one which might have customers. What is important is the substance rather than the form: a customer investing in an investment business of any type will not cease to be a customer for these purposes simply because, as a matter of legal form, they become a partner or a shareholder. Similarly, even when a fund is formed by a limited number of people, the pooling of assets is not a “division of labour within a business”, it is the carrying out of the business.

2.2.8 Similarly, a person who is an employee of a business does not carry on that business by virtue of being an employee. Where a person enters into employment and carries out activities on behalf of their employer, it is the employer and not the employee, who is conducting the business for and on behalf of a customer. Those customers would be the customers of the employer, and the transactions with those customers would be conducted in the course of the employer’s business.

2.2.9 Where an employer sets up a scheme for its own employees to give entitlement to performance related fees or dividends from the employer’s business as part of remuneration arrangements for management of its business “employee incentive arrangements” the employees may not be customers.

2.2.10 For FIs only, where there is no customer, then they do not qualify as a financial services business under Section 1.3 even if they firmly fall into the other two aspects referred to above. A person would not be considered to be conducting FI activities or operations for or on behalf of a customer in certain situations, for example:

2.2.10.1 A person conducting the activity of trading (Schedule 2, Part 2, paragraph 8) solely with their own money, and solely on their own behalf, would not be doing so for a customer

2.2.10.2 A person conducting an activity or operation (person 1):

(a) for another person (person 2) that is under the same legal and equitable ownership as person 1 where the activities are part of business activity under common direction. The test for common ownership is factual and there is no reference to the three-tier test which would be inappropriate to apply in these circumstances. Also, different considerations may apply where such related entities exist in different jurisdictions, as this may weaken common direction; and

(b) where there are no other persons involved in the conduct of the activity or operation outside of that same legal and equitable ownership; or

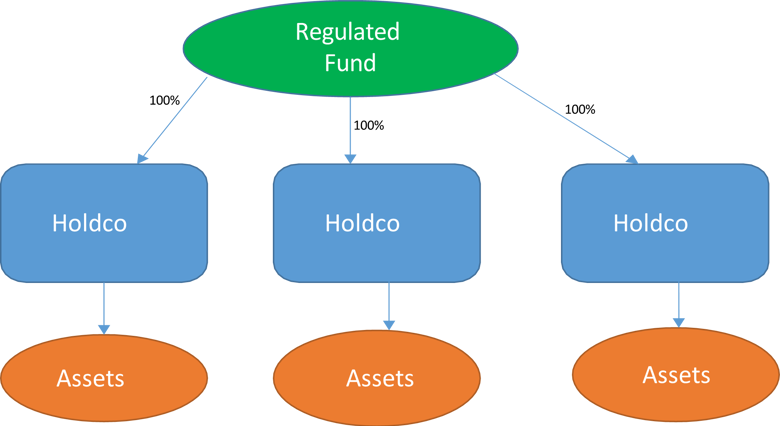

2.2.11 A person who owns securities, where the person is a company and its sole activity is for itself and its sole owner (e.g. a holding company owned by a fund/pension fund), is not acting for “other persons” who are customers. Where this entity undertakes other activities, this may mean that this entity is in scope, such as where it is lending or where third-party investors are admitted.

2.2.12 The issuance of a company’s own shares or bonds will/does not automatically mean that company is a Financial Institution. An issuer of securities will only be in scope if it issues securities as a business and does so for or on behalf of its customers (see also 3.12.1). For example, Apple and Google are not considered to be FI’s as they are not, as a business, issuing their shares for a customer.

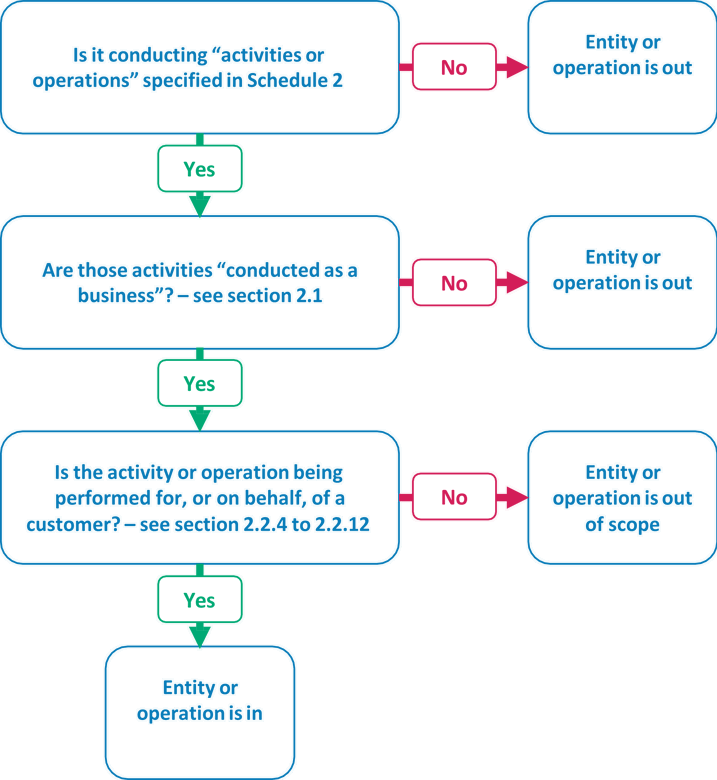

2.2.13 The following flow chart is to assist with considering whether the activities or operations of a person are in scope as an FI activity or operation:

2.3 Virtual Asset Service Providers (VASP)

2.3.1 The FATF Standards define VASP (Schedule 2, Part 4) as:

2.3.1.1 Virtual Asset Service Provider means any natural or legal person who is not covered elsewhere under the Recommendations, and as a business conducts one or more of the following activities or operations for or on behalf of another natural or legal person […].

2.3.2 Determining whether an activity or operation is within the definition of VASP features three aspects:

2.3.2.1 Conducts relevant activities or operations

2.3.2.2 Does so “as a business”

2.3.2.3 Does so for or on behalf of another natural or legal person.

2.3.3 The first two aspects follow the same pattern described at Section 1.3.

2.3.4 In addition, the activity or operation that is conducted as a business needs to be for or on behalf of another natural or legal person. Schedule 2, Part 4, paragraph 25(2) includes where a legal person acts as governing body in relation to legal arrangements within this definition.

2.3.5 Without the activity or operation being performed for or on behalf of another person, it would not be considered a VASP activity or operation and so would be excluded.

2.3.6 “Another person” captures a broad range of other parties. If conducting VASP activities or operations for, or on behalf of any other parties, the person would be conducting VASP activity.

2.3.7 For example, a person undertaking the activity of exchange between virtual assets and fiat currencies (Schedule 2, Part 4, paragraph 25(2)(a)) solely with their own currency or virtual asset, and solely on their own behalf, would not be doing so for another person.

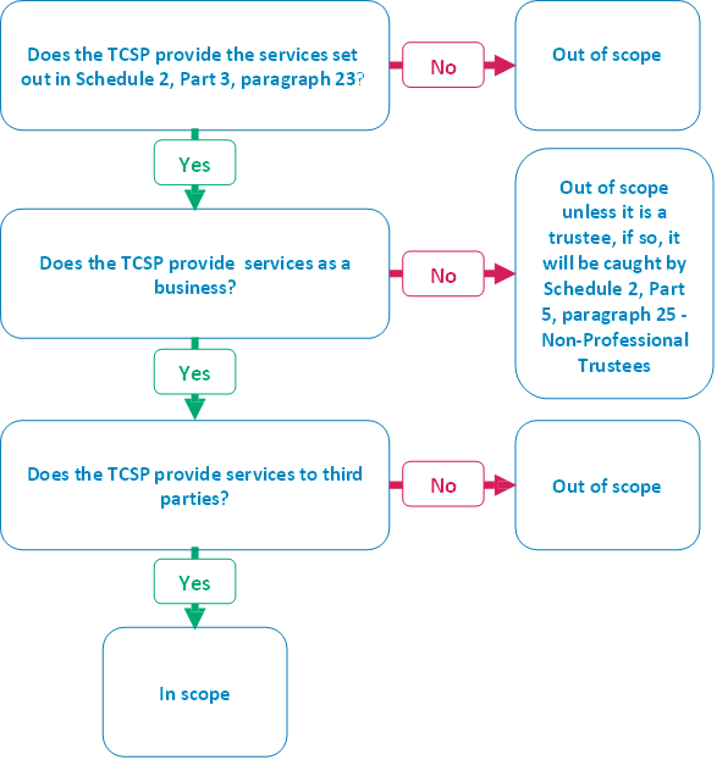

2.4 Trust and Company Service Providers (TCSP)

2.4.1 The FATF Standards define the DNFBP activity of TCSP (Schedule 2, Part 3, paragraph 23) as:

2.4.1.1 Trust and Company Service Providers refers to all persons or businesses that are not covered elsewhere under these Recommendations, and which as a business, provide any of the following services to third parties […].

2.4.2 Determining whether an activity or operation is within the definition of TCSP features three aspects:

2.4.2.1 Provides relevant services

2.4.2.2 Does so “as a business” and

2.4.2.3 Does so to third parties.

2.4.3 The first aspects follow a similar pattern to that described at Section 1.3. However, rather than conducting relevant activities or operations, a TCSP provides relevant services, as a business.

2.4.4 In addition, the activity or operation that is conducted as a business (Article 36) and the TCSP service that is provided (FATF Standards) needs to be provided to third parties.

2.4.5 “Third party” is a broad concept in the context of TCSPs and consideration should include similar considerations for “customers” in the context of FIs (see 2.2.5 and 2.2.6). Consideration of the term “third party” should not be limited to persons twice removed from the TCSP (for example, the customer of a customer). Rather “third party” should also include:

2.4.5.1 a person who has entered into an agreement for the provision of a service to be provided by the TCSP when carrying on a TCSP activity or operation, for example providing TCSP services to a settlor, instigator, promoter, or investment manager or

2.4.5.2 a person who has received or may receive the benefit of services provided or arranged by a TCSP when carrying on a TCSP activity or operation, for example to a limited partner.

2.4.6 In relation to a person who is a trustee a third party includes:

a) a settlor, and a protector, of a trust

b) a person who, having regard to the risk of the person’s being involved in money laundering, has a beneficial interest in the trust and

c) is an object of a power in relation to the trust, and to a person who otherwise exercises control over the trust.

2.4.7 This includes where a person receives, or will receive in the future, any form of compensation (financial, or otherwise) for providing TCSP services provided to another person. That other person would, in most cases (see 2.4.8 - 2.4.10), be a “third party”.

2.4.8 It is important to draw a distinction between the different business and customer relationships that may exist (or not):

2.4.8.1 Normally, a person who takes on the role of a director (for example) of a company has no business of their own, and no customer in the ordinary sense of the word. Such a director is no different to any other person who applies for a position and is taken on.

2.4.8.2 However, a person may be in the business of providing directorial services. The companies that employ such a person will have a business relationship with the company for or to whom they provide a person to be director. In forming and maintaining that relationship, the company is the customer of the director. The director carrying out the services under that customer relationships may be acting indistinguishably from an ordinary director employed by a single company.

2.4.8.3 The company may itself have its own customers. The director may well be the one who is in charge of those customer relationships. But they are not the director’s own business and customer relationships.

2.4.9 In cases where a person provides a TCSP service to another person and:

2.4.9.1 That service is to act as a director or secretary of a company, a partner of a partnership, or a similar position in relation to other legal persons or arrangements (Schedule 2, Part 3, paragraph 23(2)(b)(i))

2.4.9.2 That service is not arranging for another person to act as a director or secretary of a company, a partner of a partnership, or a similar position in relation to other legal persons or arrangements (Schedule 2, Part 3, paragraph 23(2)(b)(ii)) and

2.4.9.3 The person meets one of the following criteria in respect of that service:

a) The person is a salaried employee of the company, partnership, or other legal person or arrangement to which they provide the service in addition to their role as a director or secretary of the company, partner of the partnership, or a similar position in relation to another legal person or arrangement or

b) The person is a salaried employee of a registered TCSP that also provides the TCSP service of arranging for another person to act as a director or secretary of a company, a partner of a partnership, or a similar position in relation to other legal persons or arrangements to the company.

they would not be providing that TCSP service to a third party.

2.4.10 In cases where a person provides a TCSP service (person 1) to another person (person 2) and:

2.4.10.1 That person 2 is under the same legal and equitable ownership as person 1 where the activities are part of business activity under common direction. The test for common ownership is factual and there is no reference to the three- tier test which would be inappropriate to apply in these circumstances. Also, different considerations may apply where such related entities exist in different jurisdictions, as this may weaken common direction

2.4.10.2 There are no other persons in receipt of that service outside of that same beneficial ownership and control,

that person would not be providing that TCSP service to a third party.

2.4.11 A director who is holding themselves out as providing director services will be conducting a business by doing so (see the indicators at paragraph 2.1.4, above). This means that they will be conducting TCSP as a business. This applies to those who are in the business of hiring themselves out or arranging the provision of people to act as directors. If in that business a person may have one or no directorships at any one time, that person will still be conducting TCSP as business.

2.4.12 Where a person acts as the director on the board where the role is in an honorary, recreational or charitable capacity for which they receive no remuneration. e.g. serving on the board of the local bowls club company, serving on the board of a corporate trustee to a charity e.g. a museum, theatre or social project would be out of scope (in the absence of additional 'as a business' indicators).

Legal Entities that are trustees.

2.4.13 A corporate trustee, which is a company, and is acting as a trustee will in the majority of cases be considered to be acting as a business and be acting as a professional trustee and will be expected to register subject to paragraph 2.4.16. This is because they will either be conducting their own trade or be an integral part of the business offering of their wider group.

2.4.14 Where the trustee is a Private Trust Company, it will be acting as a business and will need to register as a Schedule 2 business.

2.4.15 Similarly, a legal person set up to provide any services under Schedule 2, Part 3, Paragraph 23, will be considered as acting as a business unless it is demonstrated to the contrary.

2.4.16 The NPTO was designed to cater for family/private arrangements around wealth management, inheritance, asset protection where the trustees are not receiving

2.5 Other activities and operations

2.5.1 It should be noted that the DNFBP activities of casinos, real estate agents, high value dealers, lawyers, notaries, other independent legal professionals and accountants (Schedule 2, Part 3, paragraphs 18 to 22) are not qualified in the same way in the FATF standards, i.e. the performance of these activities or operations will inherently be conducted as a business, except as outlined in Section 2.6.

2.6 Lawyers, notaries, other independent legal professionals and accountants

2.6.1 The Glossary definition for DNFBPs within the FATF Recommendations states:

“Lawyers, notaries, other independent legal professionals and accountants – this refers to sole practitioners, partners or employed professionals within professional firms. It is not meant to refer to ‘internal’ professionals that are employees of other types of businesses, nor to professionals working for government agencies, who may already be subject to AML/CFT measures.”

2.6.2 The JFSC considers that this definition excludes lawyers, notaries, other independent legal professionals and accountants who are not in private practice. In particular, Paragraph 21(2) and 22(2) both state “It is not meant to refer to “internal” professionals that are employees of other types of businesses, nor to professionals working for government agencies, who may already be subject to AML/CFT measures.”

2.6.3 In circumstances where natural persons:

2.6.3.1 Conduct activities and operations meeting the definitions for lawyers, notaries, other independent legal professionals and accountants; but

2.6.3.2 Undertake such operations or activities in an honorary, recreational or charitable capacity,

they would be unlikely to meet the second aspect at 1.3.3.

2.6.4 However, if the person at 2.6.3.1, 2.6.3.2 is acting with a view to reward in the sense of compensation or benefits in kind, that would be a powerful indicator that they are conducting the activity or operation as a business. This includes where the arrangement is for the reward to go not to the person but to some related (in the broad sense) part, e.g. another group company.

2.6.5 Where individuals within a registered Schedule 2 business of lawyers, notaries, other independent legal professionals and accountants are “partners or employed professionals” (or their equivalent), provided that:

2.6.5.1 The partner or employed professional (or their equivalent) is not conducting activities or operations independent of the Schedule 2 business and

2.6.5.2 The JFSC has been appropriately notified of the identity of relevant partners or employed professionals (or their equivalent) who are principal or key persons in accordance with the provisions of the Supervisory Bodies Law as per the required information in the application for registration as a Schedule 2 business which must be updated as required.

2.6.6 the JFSC considers that each partner or employed professional (or their equivalent) is an integral part of that registered Schedule 2 business and is not conducting the activity or operation of a lawyer, notary, other independent legal professional, or accountant as a business in their own right.

3 Guidelines on the interpretation of any provision in Schedule 2

FINANCIAL SERVICES BUSINESS

PART 1 – PRELIMINARY

3.1 Interpretation

|

1 Interpretation In this Schedule – “fund” means any scheme or arrangement which pools capital raised and operates on the principle of risk spreading; the funds being raised from offers to investors being members of the public, or investors restricted by criteria such as the number of offers, minimum subscription, or the investors’ net worth, level of financial sophistication, risk tolerance or other such criteria; “securities” means any of the following – a) shares, stock, debentures, debenture stock, loan stock or bonds; b) warrants entitling the holders to subscribe for any securities specified in sub-paragraph (a); c) units in a fund; d) life assurance policies; e) other securities of any description; “virtual asset” means a digital representation of value that can be digitally traded, or transferred and can be used for payment or investment purposes. |

3.2 “Fund”

3.2.1 The definition of “fund” is intended to be broad-ranging capturing all of the schemes and arrangements commonly used in Jersey and referred to as a “fund”, including, but not limited to:

3.2.1.1 Alternative Investment Funds

3.2.1.2 Jersey Private Funds

3.2.1.3 Legacy Private Funds such as Very Private Funds, Private Placement Funds, and COBO Only Funds

3.2.1.4 Recognized funds

3.2.1.5 Unclassified funds

3.2.1.6 Unregulated funds.

3.2.1.7 Non domiciled funds with a Jersey governing body, such as a non-Jersey limited partnership with a Jersey general partner.

3.2.2 Where an activity or operation meets both the definitions of:

3.2.2.1 “underwriting and placement of life assurance and insurance” (3.18); and

3.2.2.2 “Fund and security services activities” (3.12)

that activity or operation would be underwriting and placement of life assurance and insurance, rather than “Fund and security services activities”.

3.3 “Securities”

3.3.1 In addition to the definition at Paragraph 1 of Part 1 of Schedule 2 of the Proceeds of Crime Law, the FATF’s Guidance for a Risk-Based Approach for the Securities Sector provides additional support for identifying activities or operations that may fall within (e) of that definition (other securities of any description):

3.3.1.1 “The term “securities” is broadly defined for the purpose of this guidance as including, for instance:

a) Transferable securities, including equities and bonds or similar debt instruments

b) Money-market instruments

c) Investment funds, including units in collective investment undertakings

d) Options, futures, swaps, forward rate agreements and any other derivative contracts relating to securities, currencies, interest rates or yields or other derivatives instruments, financial indices, or financial measures, which may be settled physically or in cash

e) Options, futures, swaps, forwards and any other derivative contracts relating to commodities that must be settled in cash or may be settled in cash

f) Derivative instruments for the transfer of credit risk

g) Financial contracts for differences and

h) Options, futures, swaps, forward rate agreements and any other derivative contracts relating to climatic variables, freight rates, emission allowances or inflation rates or other official economic statistics that are settled in cash, as well as any other derivative contracts relating to assets, rights, obligations, indices and measures not otherwise mentioned in this section, which have the characteristics of other derivative financial instruments.”

3.3.2 This is further explained with the following note “The above definition is neither rigid nor exhaustive. Differences exist in legal and regulatory definitions across different jurisdictions and the securities sector continues to evolve constantly with the introduction of new securities products and services.”

3.3.3 The general approach to identifying “securities” is therefore broad by design.

3.4 Legal Arrangements

3.4.1 Activities and operations which may be referred to as “conducted by a legal arrangement” e.g. a trust or limited partnership are in fact and law carried on by the governing body of the legal arrangement acting in relation to the legal arrangement e.g. the Trustee(s) or the general partner. A trustee will be a financial services business, for example as a TCSP in its own right and may also be conducting activity that is in scope of the list of activities in Schedule 2 in relation to the trust such as issuing securities or lending.

3.4.2 The person acting as governing body in relation to the legal arrangement is responsible for compliance with AML/CFT/CPF obligations in relation to the activities or operations it is conducting in relation to the legal arrangement.

PART 2 – FINANCIAL INSTITUTIONS

3.5 Acceptance of deposits and other repayable funds from public

|

2 Acceptance of deposits and other repayable funds from public 1) Acceptance of deposits and other repayable funds from the public. This includes private banking. 2) Sub-paragraph (1) includes deposit-taking business within the meaning given under Article 3(1), (2) and (3) of the Banking Business (Jersey) Law 1991. |

3.5.1 The FATF Standards are clear that the FI activity or operation of the Acceptance of deposits and other repayable funds from public also captures private banking.

3.6 Lending

|

3 Lending 1) Lending. 2) Sub-paragraph (1) includes inter alia: consumer credit, mortgage credit, factoring, with or without recourse; and finance of commercial transactions (including forfeiting). |

3.6.1 In addition to the general considerations at 2.1 in respect of “conducted as a business” the JFSC would not consider lending between family members (for example parents lending their children money) to be within the scope of the FATF definition of lending.

3.6.2 Where lending is by or to a person that is not a natural person, including where a person is acting as governing body on behalf of a legal arrangement detailed, documented consideration should be given as to whether this is lending as a business.

3.6.3 Factors that generally indicate a lending arrangement is in scope, and these are non- exhaustive, including:

3.6.3.1 The loan transactions are frequent

3.6.3.2 The lending forms part of a commercial transaction

3.6.3.3 The loan is on commercial terms with regular repayments culminating in an indicative final date for repayment

3.6.3.4 The lender takes security, involves a guarantor or has a lien to ensure repayment of the loan

3.6.3.5 Interest is paid to the lender on the loan and

3.6.3.6 The lender is making a profit on the loan.

3.6.4 Loans between intra group companies/ group companies or connected companies may still be conducting lending as a business depending on the circumstances, noting the indicators above. For example, an intragroup company that is lending on commercial terms to other group companies between legal persons that are connected via common ownership may be as a business. For example, if the issuance of loans is its primary purpose, then it is likely to be lending as a business.

3.6.5 A one-off intercompany loan is unlikely to be conducting the business of a lender.

3.7 Financial leasing

|

4 Financial leasing 1) Financial Leasing. 2) Sub-paragraph (1) does not extend to financial leasing arrangements in relation to consumer products. |

3.8 Money or value transfer services

|

5 Money or value transfer services 1) Money or value transfer services. This does not apply to any natural or legal person or arrangement that provides financial institutions solely with message or other support systems for transmitting funds. 2) Sub-paragraph (1) includes money service business within the meaning given under Article 2(9)(b), (c) and (d) of the Financial Services (Jersey) Law 1998. |

3.8.1 In addition to the definition at Schedule 2, Part 2, paragraph 5, the FATF Standards define Money or value transfer services (MVTS) as:

3.8.1.1 “financial services that involve the acceptance of cash, cheques, other monetary instruments or other stores of value and the payment of a corresponding sum in cash or other form to a beneficiary by means of a communication, message, transfer, or through a clearing network to which the MVTS provider belongs. Transactions performed by such services can involve one or more intermediaries and a final payment to a third party and may include any new payment methods. Sometimes these services have ties to particular geographic regions and are described using a variety of specific terms, including hawala, hundi, and fei-chen.”

3.8.2 MVTS activity is also likely to fall within the definition of Money and currency (3.19).

3.9 Means of payment

|

6 Means of payment Issuing and managing means of payment (such as credit and debit cards, cheques, traveller’s cheques, money orders and bankers’ drafts, and electronic money). |

3.9.1 “Electronic money” includes prepaid cards and other stores of value in electronic form that do not necessarily involve bank accounts in transactions.

3.10 Financial guarantees and commitments

|

7 Financial guarantees and commitments Financial guarantees and commitments. |

3.10.1 The general considerations at 2.1 in respect of “conducted as a business” are relevant to determining if an activity or operation is subject to this provision.

3.11 Trading

|

8 Trading 1) Trading in - a) money market instruments (such as cheques, bills, certificates of deposit, derivatives); b) foreign exchange; c) exchange, interest rate and index instruments; d) transferable securities; or e) futures and options (financial and commodity). 2) Sub-paragraph (1) includes investment business within the meaning given under Article 2(2)(a) and (b) of the Financial Services (Jersey) Law 1998. 3) In this paragraph “trading” includes acting as a principal or agent. |

3.11.1 In addition to the general considerations of “conducted as a business” at Section 2.1, and where relevant, whether the person has a “customer” the JFSC does not consider “trading” to capture a situation where, for example, a retired person occasionally participates in day trading entirely on their own behalf as a principal (not as an agent for another).

3.12 Fund and security services activities

|

9 Fund and security services activities 1) Participation in securities issues and the provision of financial services related to such issues. 2) Sub-paragraph (1) includes the following fund and security services activities – a) fund or issuer of securities; and b) service providers to a fund or issuer of securities, including acting as manager, administrator, designated service provider, registrar, investment manager, investment adviser, distributor, subscription agent, redemption agent, premium receiving agent, policy proceeds paying agent, purchase agent, repurchase agent, trustee, custodian, depositary, manager of a managed entity or a member of a partnership (other than a limited partner). 3) Sub-paragraph (1) includes investment business within the meaning given under Article 2(2) of the Financial Services (Jersey) Law 1998. |

3.12.1 An issuer of securities does not include an issuer of debt securities that has obtained consent under Article 4(1) of the Control of Borrowing (Jersey) Order 1958 (COBO) to the issue of such securities (or that is not required to obtain such consent by virtue of Article 4(2) of the COBO) if:

3.12.1.1 consent under Article 5 of the Companies (General Provisions) (Jersey) Order 2002 to the circulation of a prospectus in respect of such securities has been obtained; and/or

3.12.1.2 such securities are only issued to either or both (i) qualified investors as defined in Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017 on the prospectus to be published when securities are offered to the public or admitted to trading on a regulated market, as amended from time to time or (ii) professional investors as defined in the Financial Services (Investment Business (Special Purpose Investment Business — Exemption)) (Jersey) Order 2001; and/or

3.12.1.3 the minimum consideration which may be paid or given by a person for such securities acquired by that person is at least EUR 100,000 (or an equivalent amount in another currency); and/or

3.12.1.4 such securities are denominated in amounts of at least EUR 100,000 (or an equivalent amount in another currency).

3.12.2 Paragraph 3.12.1 applies in no way to the operation of paragraph 3.11 above.

3.12.3 A customer in a fund or of an issuer of securities will include investors whose investment is represented by ownership of securities in the fund or issuer of securities such that represent ownership of the fund/issuer of securities, such as shares, units, partnership interests or other interests issued by the fund/issuer of securities.

3.12.4 Securities issues is a wider term and consideration needs to be given as to entities that may be in scope, for example a trustee of a unit trust that issues units may be considered to be an issuer of securities in addition to a trustee.

3.12.5 However, an issuer of securities does not include the trustee of a trust that has obtained consent under Article 9(1) of the COBO and whose sole or principal activity is to participate in a scheme or arrangement that involves the securitisation, acquisition or repackaging of assets.

3.12.6 Note the guidance above on asset holding companies.

3.12.7 For the avoidance of doubt service providers, providing services in or from within Jersey includes where services are provided to non-domiciled funds.

3.13 Advice on capital structure, industrial strategy etc.

|

10 Advice on capital structure, industrial strategy etc. The business of providing advice to undertakings on capital structure, industrial strategy and related questions and advice as well as services relating to mergers and the purchase of undertakings. |

3.13.1 The activity or operation of advice on capital structure, industrial strategy etc will often be conducted by businesses within the definition of Financial Institutions, lawyers, notaries, other independent legal professionals and accountants (Schedule 2, Part 3, paragraphs 21- 22).

3.13.2 The community of service providers that are not otherwise registered as Schedule 2 businesses and provide general advice to other businesses on matters such as project management, compliance with regulations, recruitment, and general policies and procedures are unlikely to determine that their activities fall within Schedule 2, Part 2, paragraph 10.

3.14 Portfolio management

|

11 Portfolio management 1) Individual and collective portfolio management. 2) Sub-paragraph (1) includes – a) the business of providing portfolio management including the business of providing advice; b) investment business within the meaning given under Article 2(2) of the Financial Services (Jersey) Law 1998; c) fund and security services activities – i. fund or issuer of securities, and ii. service providers to a fund or issuer of securities, including acting as manager, administrator, designated service provider, registrar, investment manager, investment adviser, distributor, subscription agent, redemption agent, premium receiving agent, policy proceeds paying agent, purchase agent, repurchase agent, trustee, custodian, depositary, manager of a managed entity or a member of a partnership (other than a limited partner). |

3.14.1 In addition to the general considerations of “conducted as a business” at Section 2.1, the guidelines at 2.2.10 and 3.12.1 are relevant to the consideration of portfolio management.

3.15 Safe keeping and administration

|

12 Safe keeping and administration 1) Safekeeping and administration of cash or liquid securities on behalf of other persons. 2) Sub-paragraph (1) includes the business of safekeeping and administration of securities in relation to a fund, issuer of securities or other person. |

3.15.1 “Cash or liquid securities” in paragraph 12(1) includes physical notes and bearer shares as well as other securities that can be readily disposed of in exchange for their face value.

3.15.2 "Fund" in paragraph 12(2) has the meaning given in Schedule 2, Part 1, paragraph 1.

3.15.3 Where Schedule 2, Part 2, paragraph 12(1) refers to cash or liquid securities, Schedule 2, Part 2, paragraph 14 includes reference to administration of all other funds or money (see paragraph 3.17 below).

3.16 Safe custody services

|

13 Safe custody services Safe custody services in relation to other persons. |

3.16.1 Where Schedule 2, Part 2, paragraph 12 refers to cash or liquid securities, Schedule 2, Part 2, paragraph 13 includes all other funds with the FATF Standards defining funds as:

3.16.1.1 “assets of every kind, whether corporeal or incorporeal, tangible or intangible, movable or immovable, however acquired, and legal documents or instruments in any form, including electronic or digital, evidencing title to, or interest in, such assets.”

3.17 Investing, administering or managing funds or money

|

14 Investing, administering or managing funds or money Investing, administering or managing funds or money on behalf of other persons where such activities are not otherwise listed in this Part. |

3.17.1 The activity or operation of investing, administering or managing funds or money has a broad scope of application. It will only apply where activities or operations are not otherwise specified in Schedule 2.

3.17.2 “Funds” is distinct from “fund” as defined at Schedule 2, Part 1, paragraph 1. The FATF Standards define “funds” as:

3.17.2.1 “assets of every kind, whether corporeal or incorporeal, tangible or intangible, movable or immovable, however acquired, and legal documents or instruments in any form, including electronic or digital, evidencing title to, or interest in, such assets.”

3.17.3 Examples of activities and operations within this paragraph may include:

3.17.3.1 Payroll services

3.17.3.2 Debt collection

3.17.3.3 Letting companies.

3.18 Underwriting and placement of life assurance and insurance

|

15 Underwriting and placement of life assurance and insurance 1) Underwriting and placement of life insurance and other investment related insurance. This applies both to insurance undertakings and to insurance intermediaries (agents and brokers). 2) Sub-paragraph (1) includes – a) long-term business within the meaning given under Article 1(1) of the Insurance Business (Jersey) Law 1996; and b) investment business within the meaning given by Article 2(2)(a) and (b) of the Financial Services (Jersey) Law 1998. |

3.18.1 The FATF Standards are clear that the activity or operation of underwriting and placement of life assurance and insurance and other investment related insurance applies to both insurance undertakings and to insurance intermediaries (agents and brokers). This does not apply to general insurance undertakings, agents or brokers who are not involved in the underwriting and placement of life assurance and insurance and other investment related insurance. For example, undertakings, agents, or brokers involved solely in the underwriting and placement of annually renewable home and contents insurance, or annually renewable motor vehicle insurance would not be captured by this paragraph.

3.18.2 In respect of life assurance and insurance policies, the issuer of life assurance and insurance policies will not necessarily fall within the scope of portfolio management and securities issuers, notwithstanding that entitlements under policies are often backed by investments. This will be different when policies are sold as investment assets, for example Traded Endowment Policies (TEP) or Traded Endowment Investment Portfolio Plans (TIPPs). It is noted that policies may be sold on and thereafter become treated as an investment asset.

3.19 Money and currency

|

16 Money and currency 1) Money and currency changing. 2) Sub-paragraph (1) includes money service business within the meaning under Article 2(9)(a) of the Financial Services (Jersey) Law 1998 as a bureau de change. |

3.19.1 Money and currency activities and operations may also fall within the definition of MVTS (3.8).

3.20 Money broking

|

17 Money broking 1) Money broking to third parties. 2) Sub-paragraph (1) includes the business of providing the service of money broking to third parties. |

PART 3 – DESIGNATED NON-FINANCIAL BUSINESSES AND PROFESSIONS

3.21 Casinos

|

18 Casinos 1) Casinos (including internet and ship-based casinos). 2) Sub-paragraph (1) includes the business of operating a casino. 3) For the purposes of this paragraph, a person operates a casino if the person provides a service that – a) is a gambling service, within the meaning of Article 2 of the Gambling (Jersey) Law 2012; and b) consists of giving people an opportunity to participate in one or more casino games. 4) For the purposes of this paragraph – “casino” means an arrangement whereby people are given an opportunity to participate in one or more casino games; “casino game” means a game of chance – a) that involves playing or staking against a bank (whether described as a “bank” and whether or not controlled or administered by a player); and b) in which the chances are not equally favourable to all participants. |

3.22 Real estate agents

|

19 Real estate agents 1) Real estate agents. 2) Sub-paragraph (1) includes the business of providing estate agency services to, for or on behalf of third parties concerning the buying or selling of – a) freehold (including flying freehold) or leasehold property (including commercial and agricultural property); or b) shares the ownership of which entitles the owner to occupy immovable property, whether the property is situated in Jersey or overseas. |

3.22.1 Generally, activities conducted by letting agents are out of scope as acting as a real estate agent. There are two exceptions which may bring the activities of letting agents within scope:

3.22.1.1 where a letting agent creates a lease/tenancy which can be reconverted into money. Factors such as the level of the rent, the length of the term, or both, and whether the lease/tenancy has a capital value which may be lawfully realised in the open market will need to be considered, for example this may include where a Premium Lease or tenancy agreement at a high value rent is created; and

3.22.1.2 where letting agents become involved in negotiating / arranging / facilitating the purchase of a property by an existing tenant from the landlord customer.

3.22.2 Property management is a different business activity to acting as a real estate agent. The business of property management may fall within scope of Paragraph 14, Part 2 of Schedule 2 of the Proceeds of Crime Law [see paragraph 3.17 of these Guidelines] which is otherwise investing, administering or managing funds or money on behalf of other parties. It is, of course, possible that a business which primarily acts as a real estate agent also acts as a property manager. In these cases, a registration as a real estate agent may also required

3.23 High value dealers

|

20 High value dealers 1) Dealers in precious metals, precious stones and other goods. 2) Sub-paragraph (1) includes the business of providing services as a high value dealer. 3) For the purposes of this paragraph, a “high value dealer” is a person who trades in goods (including precious metals and precious stones) and receives in respect of any transaction (whether executed in a single operation, or in several operations which appear to be linked) payment of at least €15,000 (Euros) in total. 4) For the purposes of this paragraph – “payment” means payment in or by means of – a) cash, including notes, coins, travellers’ cheques, and bearer negotiable instruments; and b) any virtual asset. |

3.23.1 High value dealers include:

3.23.1.1 persons who, as a business, trade in goods and receive, in respect of any transaction (whether executed in a single operation, or in several operations which appear to be linked), payment or payments in cash or VA of at least €15,000 in total.

3.23.1.2 payment refers to payment in, or by means of Cash or Vas.

3.23.1.3 “Cash” includes, but is not limited to any of the following, in any currency – notes, coins, travellers’ cheques, bearer negotiable instruments.

3.23.1.4 “VA” means a digital representation of value that can be digitally traded, or transferred and can be used for payment or investment purposes.

3.23.2 The €15,000 threshold in Schedule 2 of the Proceeds of Crime Law is derived from the FATF Recommendations. See the FATF interpretive note on Recommendations 22 and 23.

3.23.3 The requirement to register as a high value dealer for the purposes of the Money Laundering Order includes businesses that only occasionally accept such payments.

3.24 Lawyers, etc.

|

21 Lawyers, etc. 1) Lawyers, notaries, other independent legal professionals. 2) Sub-paragraph (1) refers to sole practitioners, partners or employed professionals within professional firms. It is not meant to refer to “internal” professionals that are employees of other types of businesses, nor to professionals working for government agencies, who may already be subject to AML/CFT measures. 3) Sub-paragraph (1) includes the business of providing services by an independent legal professional. 4) In this paragraph, “independent legal professional” means a person (including a lawyer or a notary) who provides legal or notarial services to third parties when participating in financial, or immovable property, transactions concerning any of the following – a) the buying and selling of immovable property or business entities; b) the buying and selling of shares the ownership of which entitles the owner to occupy immovable property; c) the managing of client money, securities or other assets; d) the opening or management of bank, savings or securities accounts; e) the organisation of contributions necessary for the creation, operation or management of companies; or f) the creation, operation or management of trusts, companies or similar structures. |

3.24.1 Legal professionals employed by public authorities or undertakings which do not provide services to third parties are excluded from the definition.

3.24.2 A person is defined as participating in a transaction by assisting in the planning or execution of the transaction, or otherwise acting for or on behalf of a third party in a transaction.

3.24.3 Only certain legal activities are set out in Paragraph 21 and in terms of activities included it should be noted that:

managing customer money is narrower than handling it; and

operating or managing a bank account is wider than simply opening a client account. It would be likely to cover lawyers acting as a trustee, attorney or receiver.

3.24.4 As previously stated in the Handbook the Attorney General has confirmed that the following would not generally be regarded as participating in Schedule 2 business:

payment on account of costs to a legal professional or payment of a lawyer’s bill:

in respect of payments on account of costs, law firms should ensure that the payment is proportionate to the issue in respect of which the firm is asked to advise

in respect of payment of a lawyer’s bill, if payment is made out of criminal property, this would constitute an offence under Article 30 of the Proceeds of Crime Law.

Provision of legal advice:

in relation to the provision of legal advice, a lawyer needs to consider whether they are providing legal advice or whether they are a lawyer participating in a transaction by assisting in its planning or its execution. Ultimately, each case will have to be decided on its own facts and it is a matter for each firm to form a view

however, generally, the giving of generic advice, or advice specific to a transaction in terms of whether such a transaction is possible under Jersey Law or what factors are taken into account in making such a transaction possible, will only constitute the giving of legal advice where the decision has not already been taken to proceed with the transaction

where a decision has already been taken to proceed with a transaction, drafting documentation to enable that transaction to proceed, or seeking information to advise further on the planning or execution of the transaction will fall within the scope of the Money Laundering Order.

Participation in litigation or a form of alternative dispute resolution:

in relation to litigation involving trusts where the proposed resolution includes a change in trusteeship or the application related to asking the Court to approve a future transaction, then the requirements of the Money Laundering Order may apply

in respect of advising insolvency practitioners relating to individuals or entities, the requirements of the Money Laundering Order are likely to apply

corporate transactions requiring Court approval, such as schemes of arrangement, are likely to be covered by the requirements of the Money Laundering Order.

Will writing, although firms should consider whether any accompanying taxation advice is covered:

in relation to Will writing, any steps taken during the lifetime of the deponent of the Will to enable their wishes to be given effect to as recorded in the Will, may well fall within definition of Schedule 2 business in which case the requirements of the Money Laundering Order will apply.

Publicly funded work:

publicly funded work extends to individuals under the legal aid scheme, even if an individual may be required to make a contribution to the fees of the law firm.

3.24.5 Lawyers/ law firms may provide other services that will fall within the scope of another part of Schedule 2. For example, see section 2.6. and consider whether TCSP activities are being conducted for which a registration will be required.

3.25 Accountants

|

22 Accountants 1) Accountants. 2) Sub-paragraph (1) refers to sole practitioners, partners or employed professionals within professional firms. It is not meant to refer to “internal” professionals that are employees of other types of businesses, nor to professionals working for government agencies, who may already be subject to AML/CFT measures. 3) Sub-paragraph (1) includes the business of providing any of the following – a) external accountancy services; b) advice about the tax affairs of another person; c) audit services; d) insolvency services; e) advice to third parties when participating in financial, or immovable property, transactions concerning any of the following – i. the buying and selling of immovable property or business entities, ii. the buying and selling of shares the ownership of which entitles the owner to occupy immovable property, iii. the managing of client money, securities or other assets, iv. the opening or management of bank, savings or securities accounts, v. the organisation of contributions necessary for the creation, operation or management of companies, or vi. the creation, operation or management of trusts, companies or similar structures. 4) In this paragraph – “external accountancy services” means accountancy services provided to third parties and excludes services provided by accountants employed by public authorities or by undertakings which do not provide accountancy services to third parties; “audit services” are audit services provided pursuant to any function under any enactment; “insolvency services” are services provided by a person if that person accepts appointment as – a) a liquidator under Chapter 4 of Part 21 of the Companies (Jersey) Law 1991; b) an insolvency manager appointed under Part 5 of the Limited Liability Partnerships (Jersey) Law 2017 as that Law has effect in its application to insolvent limited liability partnerships under the Limited Liability Partnerships (Dissolution and Winding Up) (Jersey) Regulations 2018; or c) as agent of an official functionary appointed in the case of a remise de biens, cession, or désastre. |

Accountancy Services

3.25.1 Accountancy services is limited to services provided under a contract for services. Examples may include, but are not limited to, the recording, review, analysis, calculation or reporting of financial information. Accountancy Services provided as a business will be within scope, even if provided to a customer on a pro-bono or unremunerated basis.

3.25.2 Accountants providing services privately on an unremunerated voluntary basis are unlikely to fall within the scope of these Guidelines as they are not providing services as a business.

Tax advisers

3.25.3 The provision of tax compliance services is included within the scope of “advice about the tax affairs of another person”.

Audit Services

3.25.4 All persons who are directly involved in the acceptance and performance of a particular audit are considered to be part of the audit ‘engagement team’ and fall under the umbrella term of ‘auditors’. This includes the audit team, professional personnel from other disciplines involved in the audit engagement and those who provide quality control or direct oversight of the audit engagement. However, it does not include experts contracted by the supervised person.

Other Services

3.25.5 Accountancy businesses may provide other services that will fall within the scope of another part of Schedule 2. For example, see section 2.6. and consider whether TCSP activities are being conducted for which a registration will be required.

3.26 Trust and company service providers

|

23 Trust and company service providers 1) Formation agent a) Acting as a formation agent of legal persons or arrangements. b) Clause (a) includes – i. the business of providing services to or in respect of types of legal person or arrangement other than those described in Article 2(5)(a) and (b) of the Financial Services (Jersey) Law 1998, in the course of which services are provided that are similar or equivalent to those described in Article 2(4) of that Law as if Article 2(4) referred to that type of legal person or arrangement, and ii. trust company business under the Financial Services (Jersey) Law 1998 where the person carries on a business that involves the provision of – A. company administration services, B. services to foundations, or C. services to partnerships, and in the course of providing those services, the person provides the service of acting as a company formation agent, a partnership formation agent or a foundation formation agent. c) For the purposes of this sub-paragraph, a person acts as a company formation agent, a partnership formation agent or a foundation formation agent if the person arranges for the registration, formation or incorporation, or the sale, transfer or disposal, of companies, partnerships or foundations. d) In this sub-paragraph, a reference to a company, partnership or foundation is a reference to a company, partnership or foundation wherever incorporated or otherwise established; and to any similar or equivalent structure or arrangement, regardless of its name. 2) Director, secretary, partner, etc. a) Acting as, or arranging for another person to act as, a director or secretary of a company, a partner of a partnership, or a similar position in relation to other legal persons or arrangements. b) Clause (a) includes a person who carries on trust company business under the Financial Services (Jersey) Law 1998 where the person carrying on the trust company carries on a business that involves the provision of company administration services, the provision of services to foundations, or the provision of services to partnerships and, in the course of providing those services, the person provides the service of – i. acting as, or fulfilling the function of, or arranging for another person to act as or fulfil the function of, director or alternate director of a company, ii. acting as, or fulfilling the function of, or arranging for another person to act as, or fulfil the function of a partner of a partnership, iii. acting as, or fulfilling the function of, or arranging for another person to act as or fulfil the function of, a member of the council of a foundation, or iv. acting as, or arranging for another person to act as, secretary, alternate, assistant or deputy secretary of a company or a limited liability partnership. c) In this sub-paragraph, a reference to a company, foundation or partnership is a reference to a company, partnership or foundation wherever incorporated or otherwise established; and to any similar or equivalent structure or arrangement, regardless of its name. 3) Registered office, addresses, etc. a) Providing a registered office, business address or accommodation, correspondence or administrative address for a company, a partnership or any other legal person or arrangement. b) Clause (a) includes a person who provides trust company business under the Financial Services (Jersey) Law 1998 where the person carries on a business that involves the provision of company administration services, trustee or fiduciary services, services to foundations, or services to partnerships and, in the course of providing those services, the person provides – i. a registered office or business address for a company, a partnership or a foundation, ii. an accommodation, correspondence or administrative address for a company, a partnership or a foundation or for any other person. c) In this sub-paragraph a reference to a company, trust, partnership or foundation is a reference to – i. a company, trust, partnership or foundation wherever incorporated or otherwise established, and ii. any similar or equivalent structure or arrangement, regardless of it name. 4) Trustee of an express trust or equivalent a) Acting as, or arranging for another person to act as, a trustee of an express trust or performing the equivalent function for another form of legal arrangement. b) Clause (a) includes a person who carries on trust company business under the Financial Services (Jersey) Law 1998 where the person carries on a business that involves the provision of trustee or fiduciary services and, in the course of providing those services, the person provides the service of acting as or fulfilling or arranging for another person to act as or fulfil the function of trustee of an express trust. c) In this sub-paragraph, a reference to a trust is a reference to a trust wherever established and to any similar or equivalent structure or arrangement, regardless of its name. d) In this sub-paragraph “express trust” has the meaning given to that expression by Article 1(1) of the Financial Services (Jersey) Law 1998. 5) Nominee shareholder a) Acting as, or arranging for another person to act as, a nominee shareholder for another person. b) Clause (a) includes trust company business under the Financial Services (Jersey) Law 1998 where the person carries on a business that involves the provision of company administration services, services to foundations or services to partnerships and, in the course of those services, the person provides the service of acting as or fulfilling or arranging for another person to act as shareholder or unitholder as a nominee for another person. c) In this sub-paragraph, a reference to a company, foundation or partnership is a reference to a company, foundation or partnership wherever incorporated or otherwise established; and to any similar or equivalent structure or arrangement regardless of its name. |

3.26.1 See also 1.3.7, 1.4.3 and 3.28 in respect of Non-Professional Trustees.

PART 4 - VIRTUAL ASSET SERVICE PROVIDER

3.27 Virtual asset service provider

|

24 Virtual asset service provider 1) Virtual asset service provider. 2) Sub-paragraph (1) includes a natural or legal person or arrangement that carries on the business of conducting one or more of the following activities or operations to, for or on behalf of another natural or legal person or arrangement – a) exchange between virtual assets and fiat currencies, b) exchange between one or more forms of virtual assets, c) transfer of virtual assets, d) safekeeping or administration of virtual assets or instruments enabling control over virtual assets, e) participation in and provision of financial services related to an issuer’s offer and f) or sale of a virtual asset. 3) In this paragraph “transfer”, in relation virtual assets, means to conduct a transaction on behalf of another natural or legal person or arrangement that moves a virtual asset from one virtual asset address or account to another. |

3.27.1 A person who provides a platform for other persons to conduct the activities or operations specified in Schedule 2, Part 4, paragraph 24 is considered to be a VASP.

3.27.2 Where a person provides a platform for dealing in Virtual Assets, whether or not they engage in dealing on their own behalf, they are within the scope of the definition of VASP.

3.27.3 Where a person’s activities or operations involve the provision of services in respect of instruments enabling control over virtual assets (for example the custody of cryptographic keys), they may conclude that they do not meet the definitions of Safekeeping and administration (3.15) or safe custody services (3.16). Such persons are within the scope of the definition of VASP.

PART 5 – EXPRESS TRUSTS

3.28 Express trusts

|

25 Express trusts 1) Except as otherwise provided in this Schedule, acting as trustee of an express trust. 2) In sub-paragraph (1), “express trust” has the same meaning as is given to that expression by Article 1(1) of the Financial Services (Jersey) Law 1998.”. |

3.28.1 A financial services business that is person who is providing services as a Non-Professional Trustee to an Express Trust will not be conducting their activities or operations as a business.

See also 1.3.7 and 1.4.3. However, Article 36 and Paragraph 25, within Part 5 of Schedule 2 provide that Non-Professional Trustees are financial services business for the purpose of the Proceeds of Crime Law. As such, Non-Professional Trustees are subject to relevant obligations under Jersey’s AML/CFT/CPF regime as modified by the NPTO.

3.28.2 Non-Professional Trustees are not required to register with the JFSC under the Supervisory Bodies Law.

3.28.3 Whether a person is acting as a business is subject to the same principles as any other activity. A person who acts as a favour for family or friends, or due to some other personal commitment, and is either unpaid or receives only a token reward, will not be acting as a business and would instead be providing their services as a non-professional trustee. If the responsibilities increase and the individual begins to be paid something more like a commercial reward, then the same person may now be acting as a business, for example:

3.28.3.1 Mr Smith agrees to act personally as trustee for the Jones Family Trust. In return for the small amount of work and responsibility, the Jones family gift Mr Smith a pair of West End tickets each year. Despite the valuable reward, this is clearly not “as a business”.

Mr Smith finds himself working 10 hours per week on trust business. The Jones family agree to pay him his expenses and an hourly rate for his work, which, although lower than Mr Smith would normally charge, is still a commercial rate from which Mr Smith will be able to earn a profit. This is clearly acting “as a business”.

Thank you for your feedback.

To help us improve, tell us more about your visit today. Please fill in this short feedback survey.

This website uses cookies to analyse our traffic. To find out more read our cookie policy.