Service notice –Testing testing

Non-profit organisation thematic examination programme 2023

1 Executive Summary

During the second quarter of 2023, the JFSC undertook a thematic examination to assess the extent to which Prescribed Non-Profit Organisations (NPOs) have implemented appropriate Significant Donor records and controls.

A Prescribed NPO is required to keep a record of Significant Donors. As defined in Article 5 of the NPO Order, a Significant Donor means a person who, during the preceding 12 months, donated to the Prescribed NPO (as a single donation or cumulatively) £10,000 or above or, if less, over 50% of total donations made to the Prescribed NPO during that period. A Prescribed NPO must retain records of all Significant Donors for at least five years.

A Prescribed NPO’s Significant Donor records are a key tool to help identify those individuals or institutions who at any given time are connected to a Prescribed NPO. It is also a contributing factor to the overall mitigation of risk of the Prescribed NPO being used to assist terrorism or the financing of terrorism.

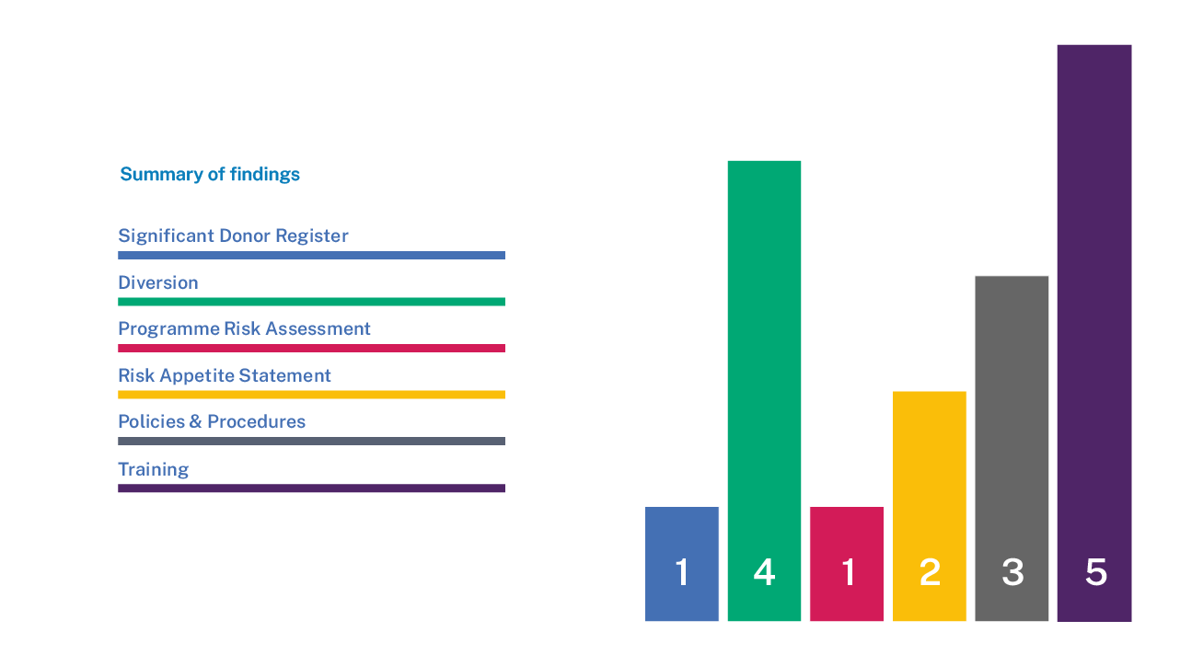

The JFSC examined eight Prescribed NPOs, which are supervised under the Law as part of this thematic. The chart below outlines areas where 16 findings and observations were identified across the eight examined Prescribed NPOs:

2 Conclusion

As a result of the examination the JFSC were able to determine that, for the most part, the Prescribed NPOs examined demonstrated a good understanding of the risks posed to the non-profit sector in the context of Significant Donors. However, there were identified areas of improvement required in respect of systems and controls which related to diversion risk and internal training.

Examples of good practice identified during the examinations have been highlighted throughout the following sections of this feedback paper. In addition, examples of best practice the JFSC would expect Prescribed NPOs to implement have also been included.

We expect Boards and Governors of all supervised persons, not just those subject to this examination, to consider their own arrangements against the matters identified in this feedback paper and make changes to their systems and controls in the event they identify any areas for development. The key findings and observations from the eight examinations undertaken were:

94% of Prescribed NPOs visited were able to demonstrate adequate significant donor records

87% of Prescribed NPOs were able to demonstrate that they had appropriate Risk Appetite Statements in place, and 94% had risk assessments in place.

81% of Prescribed NPOs were able to demonstrate their policies and procedures had been adequately updated to reflect the obligations under the Law, NPO Order and Codes of Practice.

Diversion risk – 75% of Prescribed NPOs examined were able to fully demonstrate that diversion risk had been appropriately considered, mitigated and documented. Of the remaining 25% the prescribed NPOs were able to demonstrate consideration had been given to diversion risk but they were not able to demonstrate they had recorded/evidenced that all funds had been received and used in their entirety in line with their intended purpose.

Diversion occurs where transactions by a Prescribed NPO (or Associate NPO) divert funds away from the Prescribed NPO’s legitimately intended purposes to a terrorist, terrorist cell or terrorist organisation for them to benefit from, directly or indirectly. A Prescribed NPO should seek to mitigate Diversion risk by taking reasonable steps to identify the Associates NPOs and NPO Beneficiaries it works and look to obtain reasonable assurance that the funds have reached their intended destination and have been used for their intended purpose in their entirety.

Diversion risk can be mitigated by reviewing the Prescribed NPO’s Risk Appetite Statement and accompanying programme risk assessments (PRA), or similar documents, to ensure they accurately reflect the activities of the NPO, are reviewed regularly and utilised in day-to-day operations of the Prescribed NPO. Further details on how this might be achieved are provided within this feedback paper.

Training – 62% of Prescribed NPOs were unable to fully demonstrate that training had been effectively rolled out to relevant employees and/or volunteers. It was further noted that the training did not always fully consider the risk of terrorist financing as a standalone topic.

It is recommended that representatives working for, or with, Prescribed NPOs are adequately trained in matters connected with countering the financing of terrorism. To mitigate the risk connected with Prescribed NPOs being used to assist terrorist financing, it is first important for Prescribed NPOs to understand what the risk is and how it may present in this sector.

A higher number of findings were identified within the Independent NPOs subset of the sector. This was expected due to TCB administered NPOs ability to utilise existing policies and procedures, to some extent, in their administration of the NPOs they provide services to. This should not be taken to mean that Prescribed NPOs within the Independent NPO subset are at higher risk or undertaking riskier activity, simply that certain controls require further enhancement following the introduction of the NPO Order at the beginning of the year.

All of those who were examined received direct feedback in the form of an examination findings report or letter.

3 Background and Scope

This is the first thematic assessment of the non-profit sector. The JFSC regularly undertakes thematic examinations to assess the extent to which statutory and regulatory requirements are being complied with in targeted areas. Thematic examinations will be focused on a specific topic but observations from such assessments often address wider themes as well. The purpose of this feedback paper is to publish an anonymised summary of the key findings and good practice identified during the thematic examination for the benefit of all Prescribed NPOs.

Information about the examination process is available.

The theme was chosen as the concept of Significant Donors was brought into legislation effective 1 January 2023. In addition, donations to Prescribed NPOs are diverse. For example, a significant contribution could be made by a wealthy individual or institution, or a small monthly contribution made by a member of the public. Given the diversity, it is important to assess how Prescribed NPOs across the Jersey non-profit sector are implementing the obligations in a manner that is appropriate and proportionate to their size and complexity.

To comply with Article 5 of the NPO Order, a Prescribed NPO will need to apply a level of due diligence to its Significant Donors. Prescribed NPOs should refer to their programme risk assessment (PRA) and their risk appetite statement (or equivalent documents) and use their judgement to determine how much identity information needs to be obtained.

The objective of this thematic examination was to review and assess the extent to which Prescribed NPOs were complying with their obligations and could demonstrate that they had:

Identified who would be considered a Significant Donor

Obtained sufficient identifying information of those identified as Significant Donors

Maintained a list/register of the Significant Donors.

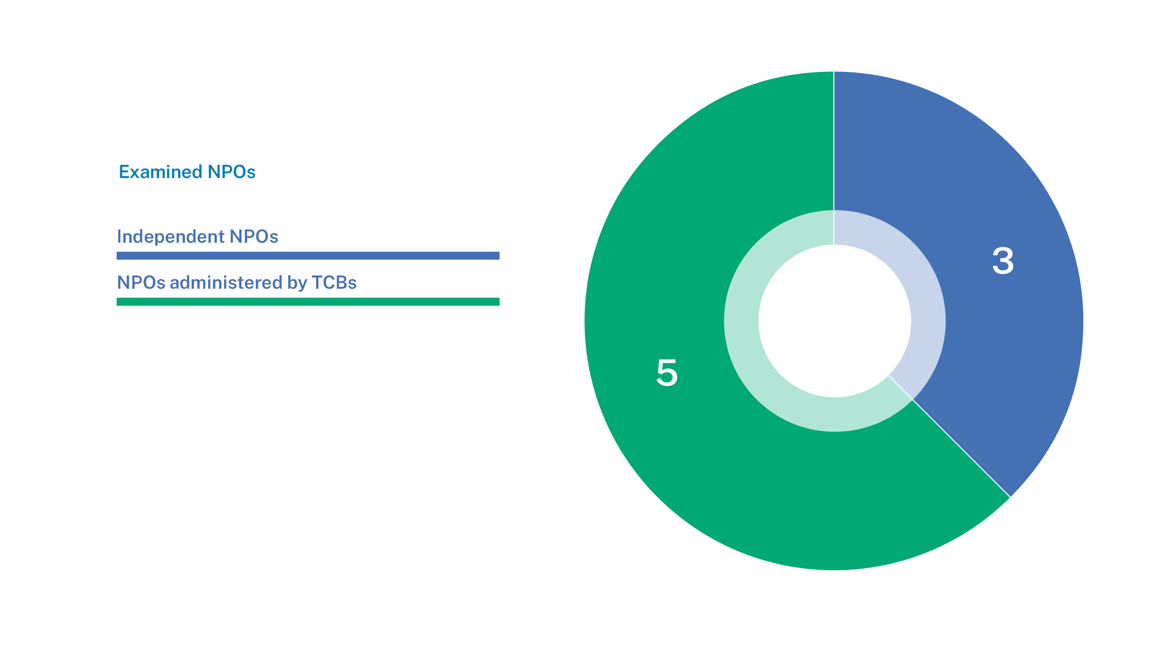

The selection process of who would partake in the thematic examination was supported by our risk model, information submitted by firms and our supervisory knowledge. The eight examined Prescribed NPOs break down as follows:

4 Key Findings and Observations

As a result of conducting eight onsite examinations, 16 key findings and observations have been identified and summarised in this section to assist a Prescribed NPO in reviewing, and where applicable enhancing, its own processes. The identified areas for enhancement, if left unresolved, could expose a Prescribed NPO to a heightened risk of failing to prevent or detect terrorist financing. In addition, the section also covers good practice observed during the onsite assessments to help Prescribed NPOs enhance their own compliance in these areas.

Findings related to the examination theme, Significant Donors

4.1 Significant Donors Register

Knowing the source of donations/funding is an important factor in a Prescribed NPOs mitigation of the risk of being used to assist terrorism or the financing of terrorism. The key obligations a Prescribed NPO must meet in connection with Significant Donors are:

Identifying who would be considered a Significant Donor

Obtaining sufficient identifying information of those identified as Significant Donors

Maintaining a list/register of the Significant Donors.

All eight Prescribed NPOs examined understood the term Significant Donors and were aware of who such parties were. However, one of the eight Prescribed NPOs has not maintained a list/register of Significant Donors.

|

Examples of good practice seen during the examination, further best practice and other resources to help Prescribed NPOs enhance compliance in this area Seven of the eight Prescribed NPOs examined maintained an electronic record of Significant Donors, containing key information to both identify the donor but also ensure salient details are held in order to contact them should the need arise. Further details on the recommended details to be held on record can be found in the Handbook, section 17.4.3. All NPOs examined held information in line with, and in some cases above, the statutory and Code of Practice requirements. While there is no requirement in the NPO Order to verify the identity information collected for Significant Donors, in some circumstances, such as when the PRA (or equivalent) produces a higher-risk outcome, the Prescribed NPO may consider it prudent to do so in order to gain sufficient comfort around the identity of the Significant Donor. In these cases, the Prescribed NPO should utilise robust, independent data sources to confirm the Significant Donor is a legitimate person or operation – see the guidance in Section 17.4.2 of the Handbook. Where a Prescribed NPO is receiving services from a regulated TCB (as defined in Section 4.4.5 of the Handbook) and it is considered appropriate to do so, the Prescribed NPO may choose to apply due diligence measures which are aligned with those set out in Sections 3 and 4 of the Handbook. All TCB administered NPOs examined had applied this approach. |

Observations made outside of the examination theme

Diversion occurs where transactions by a Prescribed NPO (or Associate NPO) divert funds away from the Prescribed NPO’s legitimately intended purposes to a terrorist, terrorist cell or terrorist organisation for them to benefit from, directly or indirectly (Diversion).

A Prescribed NPO should seek to mitigate Diversion risk by taking reasonable steps to identify the Associates NPOs and NPO Beneficiaries with whom it works and look to obtain reasonable assurance that the funds have reached their intended destination and have been used for their intended purpose. Ceding control of funds does not cede responsibility for them reaching their ultimate destination and use for their intended purpose. Checks undertaken when selecting Associate NPOs to work with, due diligence on donors and NPO Beneficiaries, and process oversight all form a crucial part of responsible NPO activity.

A risk-based approach is not intended to prevent or obstruct aid from reaching legitimate NPO Beneficiaries, but rather a way of ensuring it does in fact reach that destination. Transparency is critical for mitigating diversion risk. Adequate systems and controls can also safeguard the non-profit sector, and Jersey, from reputational damage. Robust controls also provide confidence to a Prescribed NPO’s donors and the wider donor community.

Four of the eight Prescribed NPOs examined did not fully demonstrate the mitigation of diversion risk. This included:

Two Prescribed NPOs had an Associate NPO as the recipient of donations, but insufficient information was held on where and/or how the funds were being used after this point. Two further NPOs were able to evidence that the risk of Diversion had been understood and considered by the Boards/Governors, but processes were currently being enhanced further to fully evidence funds reaching their ultimate beneficiary.

One Prescribed NPO additionally had limited evidence of the use of funding. Anecdotal confirmation or limited evidence was provided that did not provide a full breakdown of whether funds reached their intended destination and were used for their intended purpose in their entirety. A lack of receipts and/or sufficient evidence of spending meant the Prescribed NPO was unable to confirm whether funds may have been subject to Diversion.

|

Examples of good practice seen during the examination, further best practice and other resources to help Prescribed NPOs enhance compliance in this area The JFSC noted that six NPOs had a clear understanding of Diversion risk and had implemented controls to mitigate the risk. They operated in sectors/jurisdictions presenting a higher risk of Diversion. Good examples of this mitigation were: The JFSC observed six NPOs had a clear understanding of how the Risk Appetite Statement and PRA could be utilised as live documents, used to inform decision making and actions to be taken, to reduce the risk of Diversion. Six NPOs received regular reporting from NPO Beneficiaries and/or Associate NPOs to validate how funding is being used. This reporting included conditions may be placed on the funding, and updates on compliance with such conditions received. All NPOs examined conducted in-person meetings and/or video conferencing to keep in touch with NPO Beneficiaries and/or NPO Associates. Where such methods are not possible, telephone calls and emails could be utilised but should not be solely replied upon. Receipts of spending provided by the NPO Beneficiaries and/or NPO Associates may be received to confirm spending in its entirety. Whilst obtaining photographs of work undertaken can be useful, over-reliance on photographic evidence should be avoided. Photographs alone cannot show that spending was undertaken in its entirety and therefore, should be accompanied by the collation of receipts or other evidence. One NPO received photographic evidence of the beneficiary, holding the receipt next to the purchase. Four NPOs utilised photographs to document on-the-ground visits by representatives of the Prescribed NPO. Decision making/determination of Diversion risk and actions taken/not taken as a result should be recorded in the records of the Prescribed NPO. Section 17.3.1 of the Handbook states a Prescribed NPO must have internal systems and controls (including policies and procedures) in place to mitigate Diversion risk.

Section 17.3.2 of the Handbook recommends that a periodic review of a Prescribed NPO’s risks is conducted at least annually. |

To support the assessment of risks presented by a particular Prescribed NPO programme of work, a Prescribed NPO must prepare and use a Risk Appetite Statement, which is a Code of Practice requirement. This statement sets out what level of terrorist financing risk the Prescribed NPO is prepared to tolerate. The statement can be concise and performs a critical role in understanding the Prescribed NPO’s risk appetite and assisting Prescribed NPOs in making informed decisions about whether to proceed with the programme of work.

Two of the eight Prescribed NPOs examined had incomplete Risk Appetite Statements.

One Prescribed NPO’s Risk Appetite Statement had been drafted but not yet formally approved by the relevant Board/Governors.

One Prescribed NPO had no Risk Appetite statement.

|

Examples of good practice seen during the examination, further best practice and other resources to help Prescribed NPOs enhance compliance in this area A Risk Appetite Statement should confirm, at a minimum, that the Prescribed NPO will not tolerate diversion, nor work with third parties that enable diversion. It should also consider and document other risk factors. Section 17.3.1 paragraph 37 of the Handbook provides further details on the types of risk that could be considered by the Risk Appetite Statement. The Risk Appetite Statement should undergo an annual review and approval by the Board/Governors. Five NPOs examined had included this requirement within the Prescribed NPOs policies and procedures. A Risk Appetite Statement should be considered in the day-to-day operations of the Prescribed NPO. When considering a new programme of work, new donor and/or donee, or a change to the current operations of the Prescribed NPO. Where a proposed activity is not within the current parameters of the Prescribed NPO’s Risk Appetite Statement it does not necessarily mean it should not be permitted. This is a trigger for the decision makers within the Prescribed NPO to consider if risk can be mitigated to a sufficient extent that the activity can continue. An update may be required to the Risk Appetite Statement depending on the action taken. the Prescribed NPO to consider if risk can be mitigated to a sufficient extent that the activity can continue. An update may be required to the Risk Appetite Statement depending on the action taken. |

Prescribed NPOs must have internal systems and controls (including policies and procedures) in place. A Prescribed NPO may demonstrate compliance with the Order and Handbook where it establishes and maintains effective procedures governing its operations.

Three of the eight Prescribed NPOs examined, were unable to demonstrate that policies and procedures had been fully implemented.

Two Prescribed NPOs had policies and procedures which been developed and reviewed but awaited final approval by the relevant governing body of the Prescribed NPOs.

One Prescribed NPO had no documented policies and procedures in place.

|

Examples of good practice seen during the examination, further best practice and other resources to help Prescribed NPOs enhance compliance in this area Seven of the NPOs examined had policies and procedures tailored to the Prescribed NPO’s activity. Where an entity (TCB or otherwise) has existing policies and procedures for non-NPO operations, it should look to either tailor such policies and procedures for NPO specific matters or develop standalone policies and procedures for their Prescribed NPO(s). Policies and procedures, or updates thereto, should be approved by the Board/ Governors. Five of the NPOs examined were able to demonstrate that this had already taken place. Employees, volunteers, and other relevant parties should be aware of such policies and procedures and, where appropriate, confirm they have read and understood the policies and procedures. Policies and procedures should be written to allow any new employee and/or volunteer to the Prescribed NPO, or an individual of any level or experience, to understand how the Prescribed NPO should be operated and the processes to be followed to ensure risk is sufficiently mitigated in day-to-day operations. Training should be provided to employees and/or volunteers on the use of policies and procedures. |

4.5 Programme Risk Assessment (PRA)

A risk-based approach can be established through the completion of a PRA. The PRA looks at each risk faced by the Prescribed NPO, the likelihood and impact or such a risk occurring and the mitigants in place.

A PRA could be implemented to assess, and as far as possible mitigate, potential risks associated with the activities of Prescribed NPO. The Handbook recommends a PRA is implemented to make the above assessment. Where a Prescribed NPO chooses not to maintain a PRA it will be expected to demonstrate how an alternate measure they have applied is equally as robust (17.1 paragraph 11 of the Handbook).

One of the eight Prescribed NPOs examined was unable to demonstrate the implementation of a risk assessment as no assessment had been undertaken, either by way of a programme risk assessment or another equally robust measure.

|

Examples of good practice seen during the examination, further best practice and other resources to help Prescribed NPOs enhance compliance in this area Seven NPOs demonstrated a clear understanding of the risks presented to the Prescribed NPO by way of detailed PRAs, or equivalent documentation, containing details of risks present and mitigation in place to reduce that risk. The PRA should be undertaken as soon as reasonably practicable before the Prescribed NPO commences its programme of work and recorded to assist the Prescribed NPO in demonstrating its risk and related risk mitigation for a particular programme of work. When conducting a PRA care should be taken not to focus too much on any single risk factor. All aspects of the political, economic, geographical, technological, social and sanction risk environment in the area of the Prescribed NPO’s operations should be considered. Section 17.3.1 paragraph 27-36 of the Handbook provides further details on the purpose and content of the PRA, including a template that can be used as a starting point (link to template contained within 17.3.1 paragraph 35 of the Handbook). The PRA should be undertaken by the Board/Governors and/or senior officers, with support from employees and/or volunteers as deemed appropriate. The PRA should also be approved by the Board/Governors. Prescribed NPOs should also take into account any risks identified by a Prescribed NPO National Risk Assessment, or similar documents.1 Risk should be considered on a cumulative basis as the overall exposure from all risks aggregated together may be greater than if they were each considered individually. A PRA should be reviewed at any point where there is a perceived change in the risk profile of the Prescribed NPO programme(s) which have been assessed (e.g., if civil unrest develops in the region where the Prescribed NPO programme is taking place). |

It is recommended that representatives working for or with Prescribed NPOs are adequately trained in matters connected with countering the financing of terrorism.

Three of the eight Prescribed NPOs examined were unable to demonstrate that training specific to the prevention of terrorist financing had been fully implemented. Five of the eight Prescribed NPOs had undertaken training in some form.

Two Prescribed NPOs had provided initial training to employees and/or volunteers working with the Prescribed NPO (or assigned to the Prescribed NPO in the case of TCB administered NPOs), with training scheduled to the wider organisation. This wider training had not been completed at the time of the examination.

One Prescribed NPO had put in place training on financial crime, but it did not specifically consider terrorist financing.

Two Prescribed NPOs provided no formal training on terrorist financing to its employees and/or volunteers.

|

Examples of good practice seen during the examination, further best practice and other resources to help Prescribed NPOs enhance compliance in this area The JFSC observed three NPOs had a comprehensive training programme for all its employees. Attendance records of training were maintained to evidence that staff were being trained on financial crime risks involved in their operations. A further four NPO’s had commenced a training programme of this nature that was in progress. The overall objective of the training delivered should be to promote an understanding of diversion risk and the ways it could manifest within the Prescribed NPO. Whilst there is no specific Code of Practice relating to training, in order to meet the requirements of the NPO Order and Code of Practice requirements in Section 17 of the Handbook, a Prescribed NPO’s employees and/or volunteers must understand the risks present in order to mitigate against them. The examinations undertaken found that Prescribed NPOs who have sought to understand the risks associated with terrorist financing within the non-profit sector have more robust controls overall. Where a Prescribed NPO decides to provide training to its employees and/or volunteers (which should include all Board/Governors), such training should cover the specific terrorist financing risks to which the Prescribed NPO may be exposed and how it might be abused for terrorist financing purposes. The training may include guidance on specific red flags and risk indicators which are relevant to the Prescribed NPO’s programme of activity. Training should be provided to employees and/or volunteers on policies and procedures, notably those processes connected with the raising of a suspicious activity report in the event of knowledge, suspicion, or reasonable ground for suspicion of money laundering and terrorist financing. Such training should include what steps should be taken if this were to occur. Best practice is to provide training to all employees and/or volunteers and not just those who are NPO client facing (in the case of TCBs where only certain teams deal directly with NPOs). Further information on how the non-profit sector may be used to assist terrorist financing can be located on our website. |

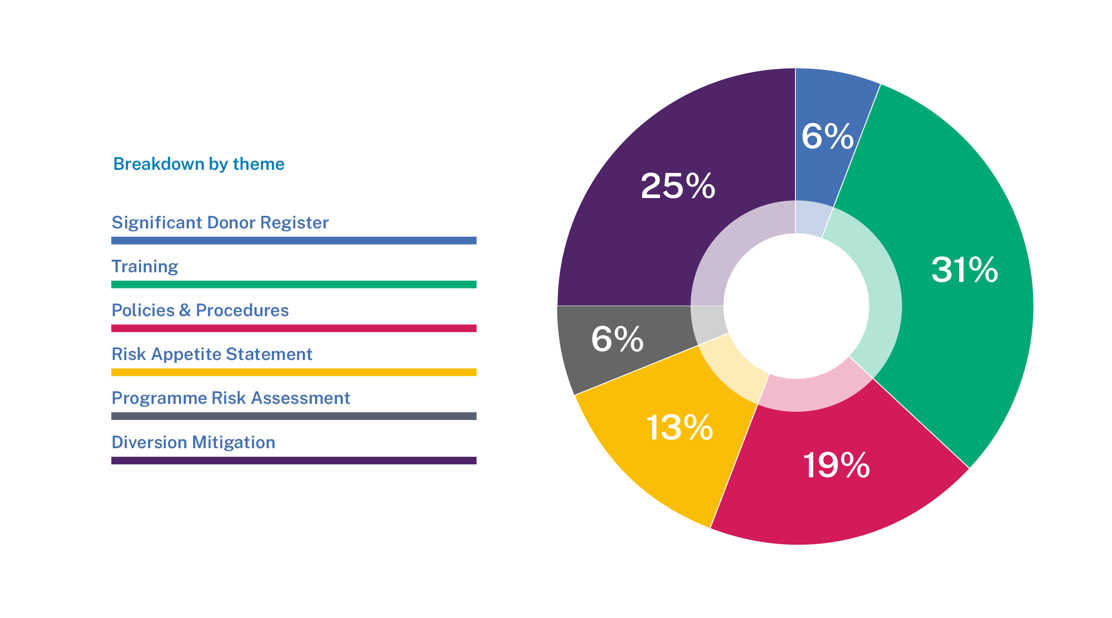

This section details how the findings from the eight examinations breakdown by theme and sector. The purpose of this data is to visually show the focus areas discussed in this feedback paper.

Breakdown by Theme - The below chart shows each finding as a percentage of overall findings.

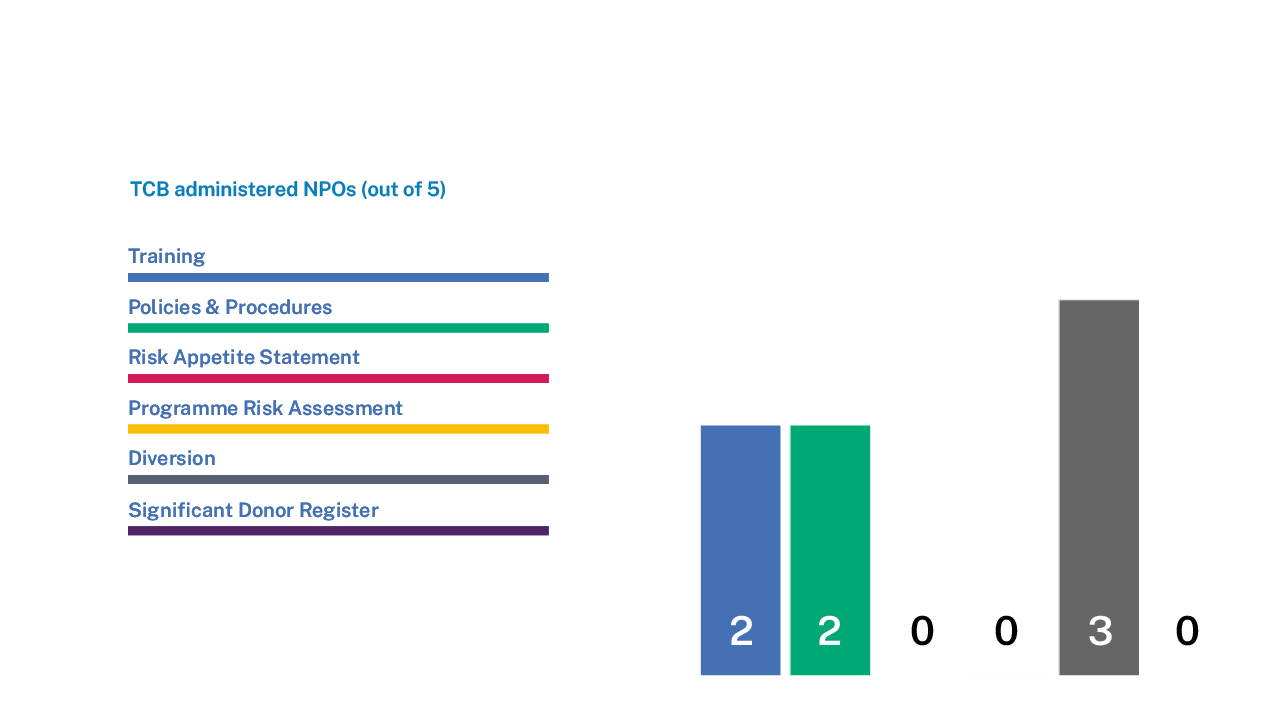

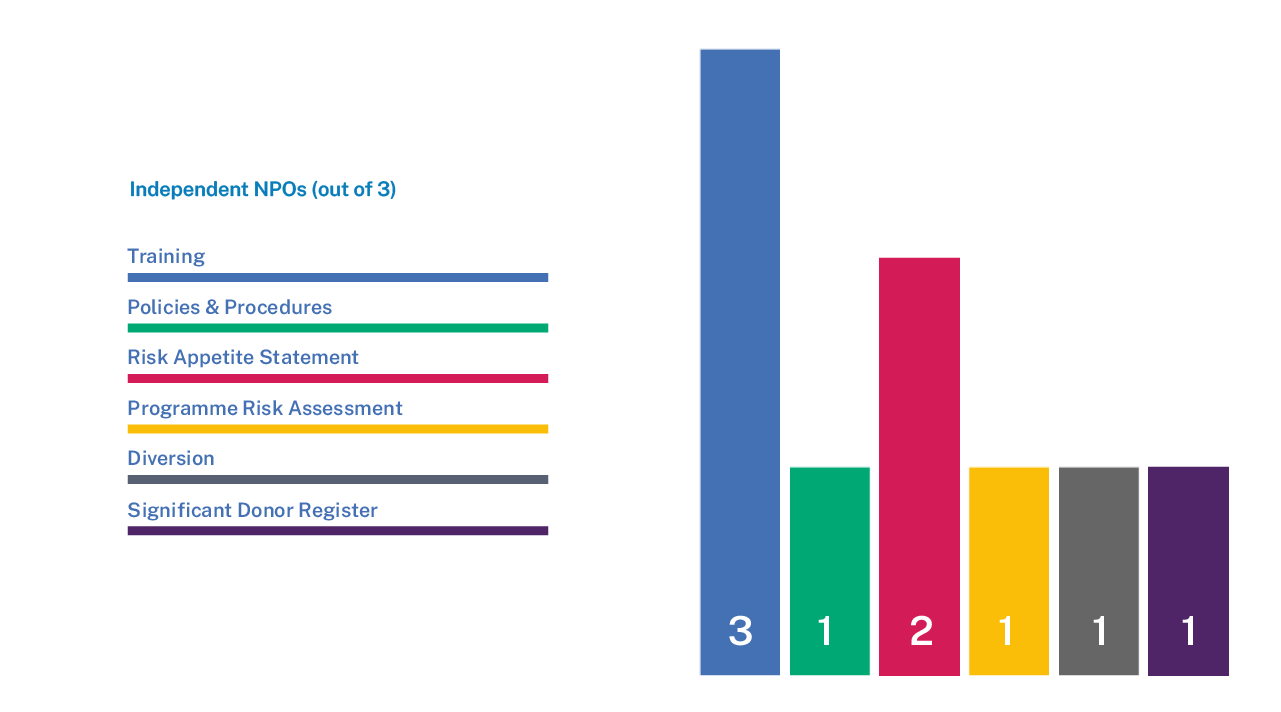

Breakdown by Sector - The below charts show the findings by sector:

TCB administered NPOs

Of the total findings 44% were attributed to TCB administered NPOs. Of the eight Prescribed NPOs examined, five were TCB administered NPOs. Those findings break down as follows:

Independent NPOsOf the total findings 56% were attributed to independent NPOs. Of the eight Prescribed NPOs examined, three were Independent NPOs. Those findings break down as follows:

5 Next Steps

All Prescribed NPOs examined have received direct feedback from us. The Prescribed NPOs with findings were required to confirm remediation of such findings and/or submit a formal remediation plan setting out actions to be taken and timescales for completion.

When conducting remediation activity, we expect that issues are not reviewed in isolation, but consideration is given to the wider implications of the findings detailed in individual examination reports. JFSC supervisors work closely with Prescribed NPOs to ensure that the steps taken to address findings are appropriate to the scale of risks identified.

A key component of regulatory effectiveness is to ensure that where a Prescribed NPO has completed remediation activity, they have done so in a way that is not only effective but is also sustainable in order to demonstrate compliance with the statutory and regulatory requirements on an ongoing basis.

We may, in certain cases, mandate remediation effectiveness testing on a risk-based approach, following confirmation of completion of remedial activity from Prescribed NPOs. Further guidance on our examination process and our remediation process can be found on our website. Where serious, significant and/or material breaches are identified, we consider the appropriate level of response on case-by-case basis with the supervised person. In some cases, this may result in a referral to the JFSC’s Heightened Risk Response team and in other, more serious cases, formal enforcement action may follow.

We expect Boards/Governors of Prescribed NPOs who were not involved in the examination to consider the findings and observations highlighted in this feedback paper against their own arrangements to ensure their Prescribed NPO is complying with all relevant statutory and regulatory requirements in connection with Significant Donors, and to mitigate the risk of being used to assist terrorist financing as noted within the wider themes addressed within this feedback paper.

In future engagements with us, Prescribed NPOs may be asked to evidence steps taken to address identified area for enhancement in their control environment.

Where this action is not considered adequate or where we identify deficiencies of a similar nature to those highlighted in our feedback papers, we will consider our future supervisory strategy and where appropriate, regulatory action.

In future planning, we will consider repeating this thematic examination, to test whether Prescribed NPOs have taken on-board the findings, observations and examples of best practice provided in this feedback paper and whether the compliance rates have increased. Based on current findings, it is possible that future examinations undertaken by the JFSC in the non-profit sector would centre around the themes of Diversion and training.

6 Glossary

|

Term |

Definition |

|

Associate NPOs |

Has the meaning given in Article 6(2) of the Non-Profit Organisations (Prescribed NPOs – Additional Obligations) (Jersey) Order 2022 [the Prescribed NPO Order]. May also be referred to as “partners” by the non-profit sector. |

|

Boards/Governors |

Person(s) appointed as the controllers of the NPO |

|

Code of Practice |

Codes of Practice for supervised persons, issued under Article 22 of the Proceeds of Crime (Supervisory Bodies) (Jersey) Law 2008. These are the regulatory requirements that must be followed by Prescribed NPOs as listed in Section 17 of the Handbook. |

|

Diversion |

Diversion has the meaning of “transactions by NPO Representatives or external parties such as associate NPOs that divert funds away from the NPO’s legitimately intended purposes to a terrorist, terrorist cell or terrorist organisation for them to benefit from, directly or indirectly”. |

|

Handbook |

The Handbook covers persons that the JFSC supervise who are supervised persons or who carry on supervised business. Prescribed NPOs must follow Section 17 of the Handbook: Section 17 Handbook |

|

Independent NPOs |

NPOs that do not receive services from a local trust company business. |

|

Law |

|

|

National Risk Assessment |

Jersey's non-profit organisations have been assessed to determine the risk they face of being abused or misused for terrorist financing (TF). The Bailiwick of Jersey: National Risk Assessment of Non-Profit Organisations is the first assessment of the risk to be published. National Risk Assessment of Non-Profit Organisations |

|

NPO |

Non-profit organisations – defined under Article 1 of the Non-Profit Organizations (Jersey) Law 2008 [the Law]. The sector may also be referred to as the non-profit sector. |

|

NPO Beneficiaries |

Natural persons or groups of natural persons who receive humanitarian, charitable or other types of assistance through the services of a non-profit organisation [NPO]. |

|

NPO Order |

Non-Profit Organisations (Prescribed NPOs – Additional Obligations) (Jersey) Order 2022. |

|

Prescribed NPO |

Has the meaning given in Article 1 of the Non-Profit Organisations (Prescribed NPOs – Additional Obligations) (Jersey) Order 2022 [the NPO Order]. The sub-set of NPOs which present a higher risk of being abused for terrorist financing purposes [Prescribed NPOs]. |

|

Programme Risk Assessment (PRA) |

A risk-based approach can be established through the completion of a NPO programme risk assessment. The programme risk assessment looks at each risk faced by the NPO, the likelihood and impact or such a risk occurring and the mitigants in place. |

|

Risk Appetite Statement |

This statement is a Code of Practice requirement, which sets out what level of risk the Prescribed NPO is prepared to tolerate and equipped to sufficiently mitigate. |

|

Significant Donor |

Has the meaning given in Article 5 of the Non-Profit Organisations (Prescribed NPOs – Additional Obligations) (Jersey) Order 2022 [the NPO Order]. |

|

Supervised Person |

Defined in Article 1 of the Proceeds of Crime (Supervisory Bodies) (Jersey) Law 2008 [the Supervisory Bodies Law]. Prescribed NPOs are classed as Supervised Persons. |

|

TCBs |

Has the meaning given at Article 2(3) of the Financial Services (Jersey) Law 1998. Persons carrying on Trust Company Business may also be referred to as “Trust and company service providers” or “TCSPs”. |

Thank you for your feedback.

To help us improve, tell us more about your visit today. Please fill in this short feedback survey.

This website uses cookies to analyse our traffic. To find out more read our cookie policy.

Non-profit organisation thematic examination programme 2023

Non-profit organisation thematic examination programme 2023