Service notice –Testing testing

Feedback from Transaction Monitoring Questionnaire

Introduction

In July 2021, we asked 25 businesses to complete a questionnaire to enable us to understand the methods they use to monitor transactions and their relevant systems and controls (including policies and procedures).

Each of the 25 businesses was a relevant person as set out in the Money Laundering (Jersey) Order 2008 (the Order). For the purposes of this report, a relevant person is:

- registered with the JFSC under one of the regulatory laws is referred to as a regulated business or

- carrying on a business described in Part B of Schedule 2 to the Proceeds of Crime (Jersey) Law 1999 is referred to as a Schedule 2 business.

All relevant persons are required by the Order to ensure that systems and controls are established to enable the identification and scrutiny of:

- Complex or unusually large transactions

- Unusual patterns of transactions which have no apparent economic or visible lawful purpose

- Any other activity that a relevant person regards as particularly likely by its nature to be related to the risk of money laundering.

The Order also sets out that on-going monitoring must involve amongst other things, scrutinizing transactions undertaken throughout the course of a business relationship, to ensure that the transactions being conducted are consistent with the relevant person’s knowledge of the customer, including the customer’s business and risk profile (including where necessary, the source of the funds).

The relevant Handbooks for the Prevention and Detection of Money Laundering and Countering the Financing of Terrorism (the Handbooks) set out regulatory requirements for relevant persons in relation to scrutinising transactions and monitoring activity.

The relevant Handbooks also provide guidance to relevant persons on how to demonstrate that transaction and activity monitoring arrangements, and associated systems and controls, are adequate and effective.

The questionnaire explored compliance with these matters and provides meaningful feedback which Boards and senior management should consider against their own arrangements, then take action where necessary to enhance their systems and controls.

Executive summary

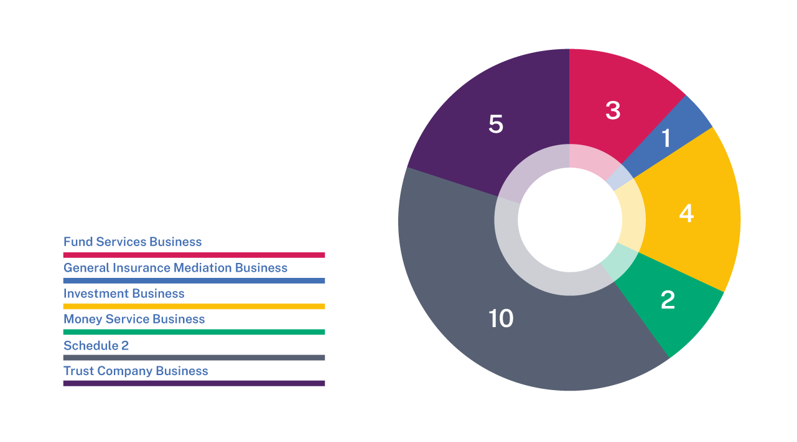

The sample of 25 relevant persons included regulated businesses from the following sectors: fund services business (FSB), investment business (IB) and trust company business (TCB). The sample also included the following Schedule 2 businesses: lawyers, estate agents, casinos, and lenders.

Manual vs automated approaches

No relevant persons used a fully automated approach to transaction monitoring with 17 (68%) confirming they use manual transaction monitoring methods both before and after a transaction has taken place. Eight (32%) of the relevant persons confirmed that they used a mix of manual and automated transaction monitoring processes.

When using automated monitoring methods, seven relevant persons confirmed their automated processes operated in real-time. The remaining relevant person’s automated monitoring solution scrutinised transactions post-event.

Highlighted deficiencies

A number of deficiencies were highlighted by relevant persons relating to existing systems and controls:

- One respondent indicated that no routine transaction monitoring was undertaken

- Four respondents highlighted that their systems and controls did not require them to record the findings from transaction monitoring reviews

- Seven respondents confirmed that there were backlogs in reviewing transactions or related processes

- Three respondents indicated that they had identified deficiencies in the oversight of their transaction monitoring processes

- Four respondents indicated that they had identified matters in their transaction monitoring policies and procedures that required addressing

- Four respondents confirmed that training in relation to transaction monitoring did not take account of Jersey requirements.

Highlighted good practice

There were two areas where a majority of relevant persons that received the questionnaire highlighted areas of best practice in their approaches to scrutinising transactions and monitoring activity:

- 68% of respondents confirmed that once a transaction monitoring review had been undertaken, they required a second reviewer to sign off its completion

- 53% indicated that transaction monitoring methods were tested before going live.

Enhancements to consider

Boards and senior management should consider the following actions, to enhance their systems and controls:

- Routine monitoring must be undertaken

- Systems and controls must record findings arising from transaction monitoring reviews

- Where there are backlogs in reviews, deficiencies in oversight, or identified matters that need to be addressed, business should:

- escalate to the appropriate level of management

- put plans in place to resolve these matters

- action these plans in a timely manner.

- Training in relation to transaction monitoring must take account of Jersey requirements

- A second reviewer’s sign off on transaction monitoring reviews should be considered

- Transaction monitoring methods should be tested before going live.

Follow-on actions

As a result of the findings from this questionnaire, follow-on supervisory engagement will take place with certain relevant persons. This may include formal remediation plans being agreed, or other supervisory action appropriate to the particular circumstances.

Glossary

|

Board |

Board of Directors, the Board function described in Section 2.1 of the Handbook |

|

Guidance |

Guidance provided to relevant persons in the relevant Handbook |

|

Handbook/s |

Handbook/s for the prevention and detection of money laundering and the financing of terrorism |

|

JFSC |

Jersey Financial Services Commission |

|

Order |

Money Laundering (Jersey) Order 2008 |

|

Regulatory laws |

Collectively the: Banking Business (Jersey) Law 1991; Collective Investment Funds (Jersey) Law 1988; Financial Services (Jersey) Law 1998; and Insurance Business (Jersey) Law 1996 |

|

Regulated business |

A person that is registered with, or holds a permit issued by, the JFSC under one of the regulatory laws |

|

Regulatory requirements |

The AML/CFT Codes of Practice contained within the relevant Handbook |

|

Relevant person |

Means a person carrying on financial services business in or from within Jersey as defined under Article 1(1) of the Order |

|

Schedule 2 business |

A business described in Part B of Schedule 2 to the Proceeds of Crime (Jersey) Law 1999. Schedule 2 businesses include accountants, estate agents, the legal profession, dealers in high value goods and other businesses such as those involved in lending. |

Thank you for your feedback.

To help us improve, tell us more about your visit today. Please fill in this short feedback survey.

This website uses cookies to analyse our traffic. To find out more read our cookie policy.

Feedback from Transaction Monitoring Questionnaire

Feedback from Transaction Monitoring Questionnaire