Service notice –Testing testing

Consultation on senior management functions

- Issued:04 May 2022

-

Consultation on senior management functions

A consultation on who should be regarded as senior managers for the purposes of our civil financial penalties regime.

We invite comments on this consultation by Friday 29 July 2022. If you require any assistance, clarification or wish to discuss any aspect of the proposal prior to formulating a response you can contact us.

Our contact is:

Stephen de Gruchy

Chief Adviser, Enforcement

Jersey Financial Services Commission

PO Box 267

14-18 Castle Street

St Helier

Jersey

JE4 8TP

Telephone:+44 (0) 1534 822000

Email: [email protected]

Alternatively, Lisa Springate at Jersey Finance Limited (JFL) is coordinating an Industry response that will incorporate any matters raised by local businesses. Comments should be submitted to JFL by Friday 29 July 2022.

The JFL contact is:

Lisa Springate

Head of Legal and Technical

Jersey Finance Limited

4th Floor, Sir Walter Raleigh House

48-50 Esplanade

St Helier

Jersey

JE2 3QB

Telephone:+44 (0) 1534 836029

Email:[email protected]

It is our policy to make the content of all responses available for public inspection (unless specifically requested otherwise by the respondent).

It is the policy of JFL (unless otherwise requested or agreed) to collate all responses and share them verbatim with us on an anonymised basis (with reference made only to the type of respondent, for example: individual; law firm; trust company etc.). This collated, anonymised response will, typically, be placed in JFL’s permanent electronic archive which is currently open to all JFL members.

Glossary of Terms

|

AML/CFT |

anti-money laundering / countering the financing of terrorism |

|

Banking (General Provisions) Order |

Banking Business (General Provisions) (Jersey) Order 2002, as amended |

|

Code of Practice |

A JFSC Code of Practice referred to in Article 21A of the Commission Law |

|

Commission Law |

|

|

DNFBPs |

Designated non-financial businesses and professions (such as casinos, estate agents, lawyers, accountants and high value dealers) |

|

FSC Amendment Law |

Financial Services Commission (Amendment No.8) (Jersey) Law 2022 |

|

JFSC |

Jersey Financial Services Commission |

|

JFL |

Jersey Finance Limited |

|

key person |

a compliance officer, money laundering compliance officer or MLRO |

|

MLRO |

money laundering reporting officer (i.e. a person appointed as “reporting officer” under the Money Laundering Order) |

|

Money Laundering Order |

Money Laundering (Jersey) Order 2008, as amended |

|

PEP |

politically exposed person |

|

principal person |

has the meaning given in Article 1 of the Commission Law |

|

registered person |

has the meaning given in Article 1 of the Commission Law |

1 Executive summary

1.1 Overview

1.1.1 We are seeking feedback on a proposed notice that will define “senior management functions” for the purposes of determining which senior managers in a registered person will fall within the scope of our civil financial penalties regime.

1.2 What we are proposing and why

1.2.1 On 29 April 2022, the Financial Services Commission (Amendment No.8) (Jersey) Law 2022 (the FSC Amendment Law) came into force.

1.2.2 The FSC Amendment Law amended the Commission Law to enable us to impose a financial penalty on a person who performs a “senior management function” if they were culpable in a significant and material contravention by a registered person of the Money Laundering Order or Code of Practice.

1.2.3 The definition of “senior management function” that the FSC Amendment Law has inserted into the Commission Law requires us to designate, by means of a notice published on our website, those functions which we have determined are “senior management functions”.

1.2.4 The practical effect of such a notice will be to determine which senior managers in a registered person will fall within the scope of our civil financial penalties regime.

1.3 Who would be affected

1.3.1 The proposals in this consultation paper have the potential to affect those who hold a senior management position in a registered person.

1.3.2 In addition to affecting those who hold senior management positions in financial institutions, the proposals will also affect those who hold senior management positions in DNFBPs (such as casinos, estate agents, lawyers and accountants).

1.3.3 Although DNFBPs were not previously included in the definition of registered person used in the Commission Law for the purposes of our civil financial penalties regime, that position changed when the FSC Amendment Law came into force.

2 Consultation

2.1 Basis for consultation

2.1.1 We have issued this consultation paper in accordance with Article 8(3) of the Commission Law, as amended, under which we “may, in connection with the carrying out of its functions …consult and seek the advice of such persons or bodies whether inside or outside Jersey as it considers appropriate”.

2.2 Responding to the consultation

2.2.1 We invite comments in writing from interested parties on the proposals included in this consultation paper. Where comments are made by an industry body or association, that body or association should also provide a summary of the type of individuals and/or institutions that it represents.

2.2.2 Comments should be received by us or JFL no later than Friday 29 July 2022.

2.3 Next steps

2.3.1 Following this consultation, we will publish feedback to this consultation together with the final version of our notice defining “senior management functions”.

3 The JFSC

3.1 Overview

3.1.1 We are a statutory body corporate established under the Commission Law, responsible for the supervision and development of financial services provided in or from within Jersey.

3.1.2 The Commission Law prescribes that we are responsible for:

3.1.2.1 the supervision and development of financial services provided in or from within Jersey;

3.1.2.2 providing the States, any Minister or any other public body with reports, advice, assistance and information in relation to any matter connected with financial services;

3.1.2.3 preparing and submitting to the Chief Minister recommendations for the introduction, amendment or replacement of legislation appertaining to financial services, companies and other forms of business structure;

3.1.2.4 such functions in relation to financial services or such incidental or ancillary matters:

- as are required or authorised by or under any enactment, or

- as the States may, by Regulations, transfer; and

3.1.2.5 such other functions as are conferred on the JFSC by any other Law or enactment.

3.2 Guiding principles

3.2.1 Our guiding principles require us to have particular regard to:

3.2.1.1 the reduction of risk to the public of financial loss due to dishonesty, incompetence, malpractice, or the financial unsoundness of persons carrying on the business of financial services in or from within Jersey;

3.2.1.2 the protection and enhancement of the reputation and integrity of Jersey in commercial and financial matters;

3.2.1.3 the best economic interests of Jersey; and

3.2.1.4 the need to counter financial crime in both Jersey and elsewhere.

4 Proposals

4.1 Introduction

4.1.1 On 29 April 2022, the FSC Amendment Law came into force and extended the scope of our civil financial penalties regime.

4.1.2 Amongst other things, the FSC Amendment Law amended the Commission Law to enable us to impose a financial penalty on a person who performs a “senior management function” if they were culpable in a significant and material contravention by a registered person of the Money Laundering Order or a Code of Practice.

4.1.3 Article 21A of the Commission Law (as amended by the FSC Amendment Law) provides that if we are satisfied that the contravention by a registered person was: committed with the consent or connivance of, or was attributable to neglect on the part of any person who performs (or performed) a senior management function, or aided, abetted, counselled or procured by any person who performs (or performed) a senior management function, we may impose a civil financial penalty on that person.

4.1.4 The extension of the civil financial penalties regime to those who perform a “senior management function” is required for compliance with Recommendation 35 of the Financial Action Task force (FATF). The FATF is the international body that sets global standards for the prevention and detection of money laundering and terrorist financing.

4.1.5 FATF Recommendation 35 requires, amongst other things, that countries have:

4.1.5.1 a range of effective, proportionate and dissuasive criminal, civil or administrative penalties available to deal with natural or legal persons that fail to comply with AML/CFT requirements; and

4.1.5.2 that those penalties are applicable to directors as well as senior management of financial institutions and DNFBPs (such as casinos, estate agents, lawyers and accountants).

4.1.6 More detail on the rationale for the FSC Amendment Law can be found in the Government’s associated consultation and response papers, as well as in the proposition on the law laid before the States Assembly by the Minister for External Relations and Financial Services.

4.1.7 It should be noted that the FSC Amendment Law also brought MLROs (and deputy MLROs) into the scope of our civil financial penalties regime where they are culpable in a significant and material contravention by a registered person of the Money Laundering Order or a Code of Practice. (N.B. Principal persons, such as directors of registered persons, are already in scope.)

4.2 Our proposed notice designating “senior management functions”

4.2.1 The FSC Amendment Law has inserted a definition of “senior management function” into the Commission Law.

4.2.2 That definition requires us to designate, by means of a notice published on our website, those functions which we have determined are “senior management functions”.

4.2.3 The practical effect of the notice will be to determine which senior managers in a registered person will fall within the scope of the civil financial penalties regime.

4.2.4 Under AML/CFT Codes of Practice (i.e. a Code of Practice issued pursuant to Article 22 of the Proceeds of Crime (Supervisory Bodies) (Jersey) Law 2008) the board of a registered person is ultimately responsible for ensuring that it organises and controls its affairs in a way that effectively mitigates the money laundering and terrorist financing risks that it has identified. As part of that, the board is required to clearly apportion responsibilities amongst its staff for countering money laundering and the financing of terrorism.

4.2.5 The intent of our notice is, in broad terms, to bring into the scope of the civil financial penalty regime those senior managers to whom the board has apportioned responsibilities that could carry significant AML/CFT implications.

4.2.6 In line with that, it is proposed that the notice would cover:

4.2.6.1 those individuals in a registered person – who are below board (principal person) level but above key person level – to whom the board has apportioned senior AML/CFT compliance and risk responsibilities;

4.2.6.2 those individuals in a registered person who are below board (principal person) level but directly accountable to the board or to a principal person for managing an aspect of a registered person’s affairs where the performance of that function may have an impact on the registered person’s compliance, or otherwise, with the MLO or an AML/CFT Code of Practice;

4.2.6.3 those individuals who carry out a duty or responsibility that the MLO or an AML/CFT Code of Practice requires to be performed by senior management.

4.2.7 The notice would also cover the “senior officer” appointed in relation to a Jersey branch of an overseas incorporated bank, given the compliance responsibilities such a person is given under banking legislation.

4.2.8 Appendix B contains a draft of our proposed notice, which we are seeking feedback on.

4.2.9 It is recognised that, in smaller businesses particularly, it is possible that a person falling into one of the categories of “senior management function” set out in the notice might also be a principal person and/or a key person.

4.2.10 However, that would be no different, in principle, to the current position whereby, for example, a principal person (such as a director) of a registered person might also be a key person (e.g. as the MLRO).

4.2.11 It is important to note that a senior manager may fall into Categories 1, 2 or 3 set out in the proposed notice even if they are not resident in Jersey (a Category 4 senior manager will always be outside Jersey). It is the person’s function, rather than their location, which will determine whether they are brought into scope or not. This is no different, in principle, to how the civil financial penalties regime works in respect of principal persons.

4.2.12 In due course, we intend to seek Government support for an amendment to the regulatory laws so that persons who wish to perform a “senior management function” (as designated in the final form of the notice) will require confirmation of “no objection” from us prior to their appointment (i.e. under our “personal questionnaire (PQ)” regime). (The one exception would be a person who falls into proposed Category 4 below – the “senior officer” of a bank. This is because the Banking Business (General Provisions) (Jersey) Order 2002 already requires us to approve their appointment.)

4.2.13 This would enable us to object to the person’s appointment if they were determined to not be fit and proper and ensure consistency with the existing statutory approach for principal person and key person appointments.

4.3 Category 1: A person who manages any aspect of an AML/CFT compliance/risk function

4.3.1 The proposed first category of senior management function is, “The function of managing any aspect of a registered person’s local AML/CFT compliance/risk function where that function is carried out by a person who, in the organisational hierarchy of the registered person, sits below a board level role but above the level of a key person role”.

4.3.2 Whilst a job title alone will not determine if a person falls into this category, a Category 1 senior manager might have a job title such as “Head of Compliance”, “Head of Risk, “Channel Islands Head of Compliance & Risk”, or similar.

4.3.3 Although every registered person will be structured differently, to help readers of this paper understand how Category 1 might work in relation to their particular business, some hypothetical organograms are shown in Appendix C.

4.3.4 For the avoidance of doubt, a person with management responsibilities for any aspect of a registered person’s local compliance and/or risk function but who simultaneously holds a key person role will fall into Category 1.

4.3.5 The notes to the proposed notice provide additional information on how Category 1 would apply in certain scenarios (for example, where the registered person is a branch of an overseas incorporated bank).

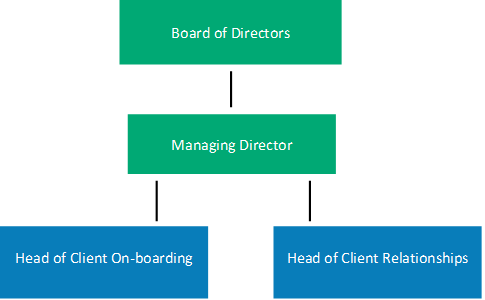

4.4 Category 2: A person whose management function may have an impact on the registered person’s compliance with the MLO or an AML/CFT Code of Practice

4.4.1 The proposed second category of senior management function is, “the function of managing any aspect of a registered person’s affairs (other than those referred to in Category 1 above) the performance of which may have an impact on the registered person’s compliance, or otherwise, with the Money Laundering (Jersey) Order 2008, as amended, or an AML/CFT Code of Practice issued by us where the function is carried out by a person who:

4.4.1.1 in the organisational hierarchy of the registered person sits below a board level role;

4.4.1.2 is directly accountable for the performance of the function to the board or to a principal person of the registered person.”

4.4.2 Senior managers falling into Category 2 are expected to include those with management responsibility for the affairs of the registered person in areas such as records management, screening of employees, client on-boarding, and on‑going client relationships.

4.4.3 Whilst a job title alone will not determine if a person falls into this category, a Category 2 senior manager might include those with titles such as, “Head of Records Management”, “Associate Director - Background Vetting”, “Head of Client On-boarding”, “Head of Client Relationships”, or similar.

4.4.4 To fall into Category 2 the person would need to be directly accountable for the performance of their management function to the board of the registered person or to a principal person, namely:

4.4.4.1 a director, controller or manager within the meaning given by Article 1 of the Banking Business (Jersey) Law 1991;

4.4.4.2 a chief executive or shareholder controller as defined in Article 1(1) of the Insurance Business (Jersey) Law 1996 or any individual acting as a director of a permit holder (within the meaning given by Article 1(1) of that Law);

4.4.4.3 a principal person as defined in Article 1(1) of the Financial Services (Jersey) Law 1998;

4.4.4.4 a principal person as defined in Article 1(1) of the Proceeds of Crime (Supervisory Bodies) (Jersey) Law 2008;

4.4.4.5 a principal person as defined in Regulation 2 of the Alternative Investment Funds (Jersey) Regulations 2012;

4.4.4.6 a principal person as defined in Article 1(1) of the Collective Investment Funds (Jersey) Law 1988.

4.4.5 Although every registered person will be structured differently, to help readers of this paper understand how Category 2 might work in relation to their particular business, some hypothetical organograms are shown in Appendix D.

4.5 Category 3: A person who carries out a duty or responsibility that is required to be performed by senior management

4.5.1 The proposed third category of senior management function is, “the function of carrying out a duty or responsibility (alone or jointly with others) that the Money Laundering Order (Jersey) Order 2008, as amended, or an AML/CFT Code of Practice requires to be performed by senior management.”

4.5.2 By way of examples, persons falling into this category would include those who:

4.5.2.1 approve (alone or jointly with others) the establishment or continuation of a business relationship with a PEP;

4.5.2.2 approve (alone or jointly with others) a new correspondent banking relationship;

4.5.2.3 approve (alone or jointly with others) the establishment or continuation of a relationship with a customer who has a relevant connection to an enhanced risk state.

4.6 Category 4: A person appointed as the ‘senior officer’ of a bank

4.6.1 The proposed fourth category of senior management function is, “the function of performing the duties of a senior officer as referred to in Article 11(2)(a) of the Banking Business (General Provisions) (Jersey) Order 2002, as amended.”

4.6.2 This category is proposed given that:

4.6.2.1 under Article 11(2)(a) of the Banking (General Provisions) Order a Jersey branch of an overseas incorporated bank must appoint a senior officer, approved by us, outside Jersey to fulfil the obligations imposed by the Banking Business (Jersey) Law 1991 on the bank; and

4.6.2.2 under the Code of Practice for Deposit-Taking Business (paragraph 3.4.1.1 thereof) the senior officer is given significant compliance responsibilities, such as approving the compliance policy of the Jersey branch.

4.6.3 (N.B. Although the appointment of a “senior officer” is subject to our personal questionnaire (PQ) regime, they do not fall within the definition of “principal person” that applies under our civil financial penalties regime – see Article 1 of the Commission Law.)

|

Do you have any issues or concerns with any of the proposed categories of “senior management function”? If you do, please set out what your issue or concern is and how you consider it should be addressed. |

|

4.6.5 Question 2 Do you consider that any other function should be included in the notice as a “senior management function”? |

5 Summary of questions

|

Page |

Question |

|

13 |

Do you have any issues or concerns with any of the proposed categories of “senior management function”? If you do, please set out what your issue or concern is and how you consider it should be addressed. |

|

13 |

Do you consider that any other function should be included in the notice as a “senior management function”? |

Appendix A - List of representative bodies and other persons who have been sent this consultation paper

- Association of Investment Companies

- Association of Jersey Charities

- Chartered Financial Advisors (UK)

- Chartered Governance Institute, Jersey branch

- Chartered Institute for Securities & Investments

- Institute of Directors, Jersey branch

- Insurance Institute of Jersey (Chartered Insurance Institute)

- Jersey Association of Directors and Officers

- Jersey Association of Trust Companies

- Jersey Bankers’ Association

- Jersey Chamber of Commerce and Industry Incorporated

- Jersey Compliance Officers Association

- Jersey Consumer Council

- Jersey Estate Agents Association

- Jersey Finance Limited

- Jersey Funds Association

- Jersey Motor Trades Federation

- Jersey Society of Chartered and Certified Accountants

- Law Society of Jersey

- Personal Finance Society

- Society of Trust and Estate Practitioners (STEP), Jersey Branch

Appendix B - Consultation draft of JFSC notice

Notice designating “senior management functions”

This notice is issued by the Jersey Financial Services Commission (“the JFSC”) pursuant to Article 1(1) of the Financial Services Commission (Jersey) Law 1998, as amended (“the Commission Law”).

Introduction

Article 21A of the Commission Law provides that where the JFSC is satisfied that a registered personNote 1 has, to a significant and material extent, contravened the Money Laundering (Jersey) Order 2008 or a JFSC Code of PracticeNote 2 the JFSC may impose a civil financial penalty on that registered person.

Article 21A of the Commission Law also provides that if the JFSC is satisfied that the contravention by the registered person was -

(a) committed with the consent or connivance of, or was attributable to neglect on the part of any person who performs (or performed) a senior management function, or

(b) aided, abetted, counselled or procured by any person who performs (or performed) a senior management function,

the JFSC may impose a civil financial penalty on that person.

“senior management function”

Article 1(1) of the Commission Law defines “senior management function” as a function designated as such by the JFSC by notice published on its website where –

(a) the function requires the individual performing it to be responsible for managing one or more aspects of the registered person’s affairs; and

(b) those aspects involve, or might involve, a risk of serious consequences –

- for the registered person, or

- for business or other interests in Jersey,

and in paragraph (a), managing one or more aspects of the registered person’s affairs includes a reference to taking decisions, or participating in the taking of decisions, about how one or more aspects of those affairs should be carried on.

Designation of senior management functions

Each of the following functions is designated as a senior management function:

This notice is dated [DDMMYYYY] and has immediate effect.

See notes overleaf.

Notes:

|

1 |

“registered person” as defined in the Commission Law. |

|

2 |

The Codes of Practice that Article 21A applies to are set out in the Commission Law |

|

3 |

anti-money laundering / countering the financing of terrorism. |

|

4 |

This includes line management responsibility for a key person (compliance officer, money laundering compliance officer, money laundering reporting officer). |

|

5 |

In a trust company business with participating members who share a compliance/risk function, the reference to “organisational hierarchy” should be taken to be that of the affiliation leader. |

|

6 |

Where the registered person is not a company “board” should be read to mean the equivalent governing body of the entity. Where the registered person is the Jersey branch of an overseas incorporated bank the reference to “below board level” should be substituted by a reference to “below the level of the senior officer required by Article 11(2)(a) of the Banking Business (General Provisions) (Jersey) Order 2002, as amended”. |

|

7 |

Compliance officer, money laundering compliance officer, money laundering reporting officer. |

|

8 |

Compliance officer, money laundering compliance officer, money laundering reporting officer. |

|

9 |

i.e. a Code of Practice issued by the JFSC pursuant to Article 22 of the Proceeds of Crime (Supervisory Bodies) (Jersey) Law 2008, as amended. |

|

10 |

In a trust company business with participating members who share a compliance/risk function, the reference to “organisational hierarchy” should be taken to be that of the affiliation leader. |

|

11 |

Where the registered person is not a company “board” should be read to mean the equivalent governing body of the entity. |

|

12 |

Where the registered person is not a company “board” should be read to mean the equivalent governing body of the entity. |

|

13 |

“principal person” as defined in Article 1 of the Commission Law. |

|

14 |

i.e. a Code of Practice issued by the JFSC pursuant to Article 22 of the Proceeds of Crime (Supervisory Bodies) (Jersey) Law 2008, as amended |

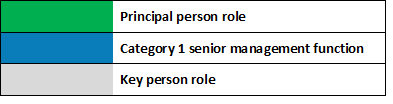

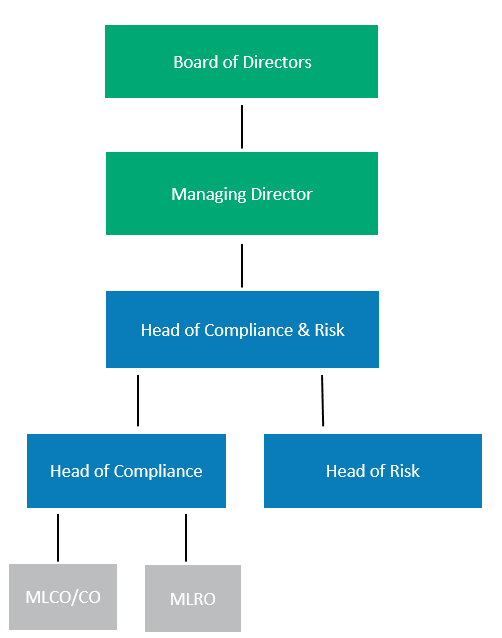

Appendix C – Hypothetical organograms showing Category 1 senior management functions

Key:

Example one

(all persons resident in Jersey)

Key

Example two

(some personnel not Jersey-resident)

Appendix D – Hypothetical organograms showing Category 2 senior management functions

Key:

Example 1

Example 2

Thank you for your feedback.

To help us improve, tell us more about your visit today. Please fill in this short feedback survey.

This website uses cookies to analyse our traffic. To find out more read our cookie policy.